Raydium is an Automated Market Maker (AMM) and liquidity provider built on the Solana blockchain for the Serum Decentralized Exchange (DEX). Raydium has first-mover advantage as an AMM within Serum and it will be an integral part of bringing new and existing projects and protocols into the ecosystem.

What is Solana?

Solana is a high-throughput blockchain that is currently supporting 50–65k transactions per second and 400ms block times, without complex solutions like sharding or layer-two. As the world’s first web-scale blockchain, Solana will unlock a whole new class of performant applications and facilitate larger scale blockchain adoption. Utilizing a revolutionary innovation called Proof of History, Solana is drastically able to outperform any other existing layer 1 and provide fees at $0.00001 per transaction.

What is SOL?

SOL is Solana’s native cryptocurrency, which works as a utility token. Users need SOL to pay transaction fees when making transfers or interacting with smart contract. The network burns SOL as part of its deflationary model. Like Ethereum, Solana allows developers to build smart contracts and create projects based on the blockchain.

SOL uses the SPL protocol. SPL is the token standard of the Solana blockchain, similar to ERC20 on Ethereum. The SOL token has two main use cases:

- Paying for transaction fees incurred when using the network or smart contracts.

- Staking tokens as part of the Proof of Stake consensus mechanism.

Where to buy SOL?

You can buy SOL on a number of popular exchanges, including the world’s top exchange in terms of trading volume Binance. Also note, there is no minimum requirement to stake SOL for delegators.

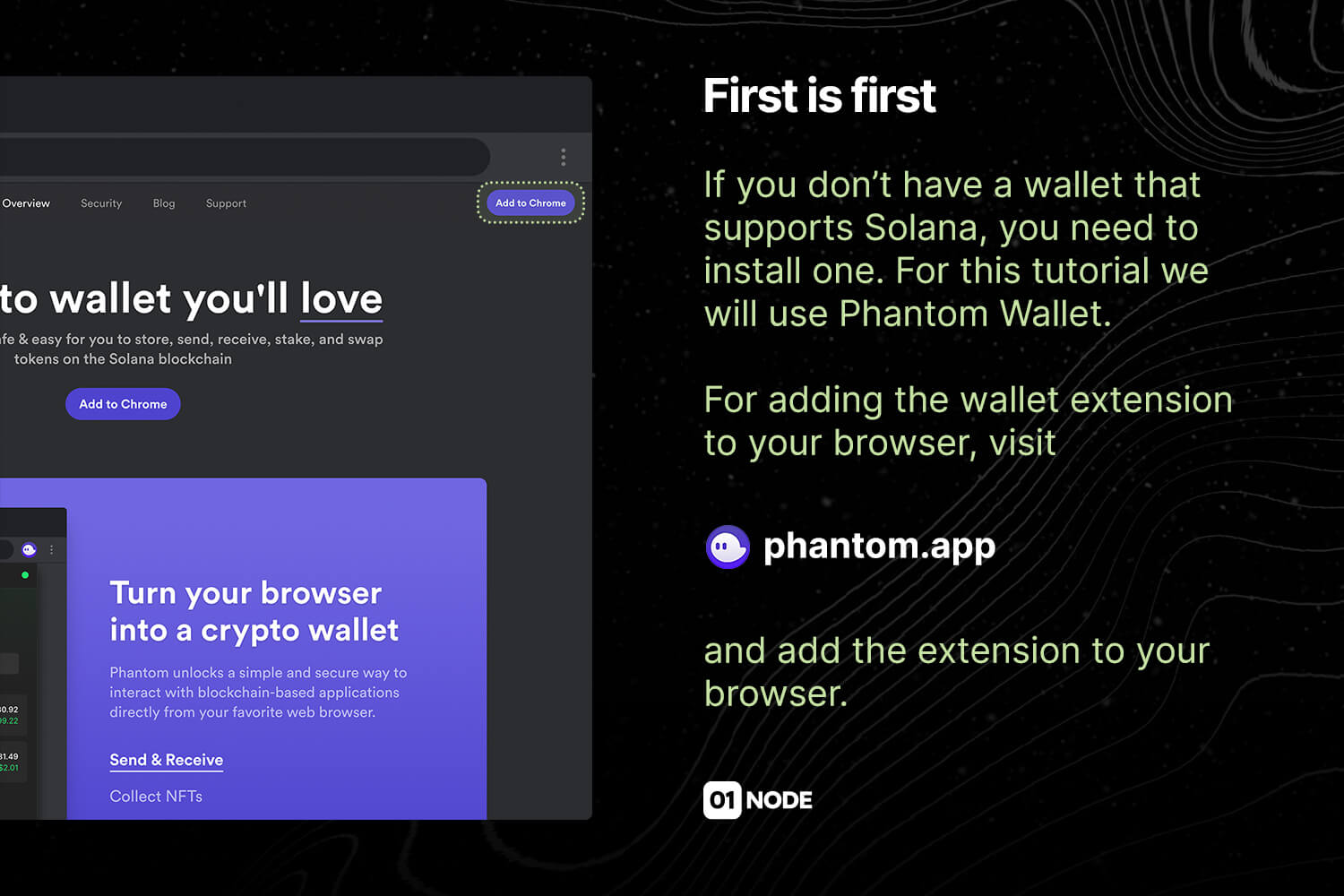

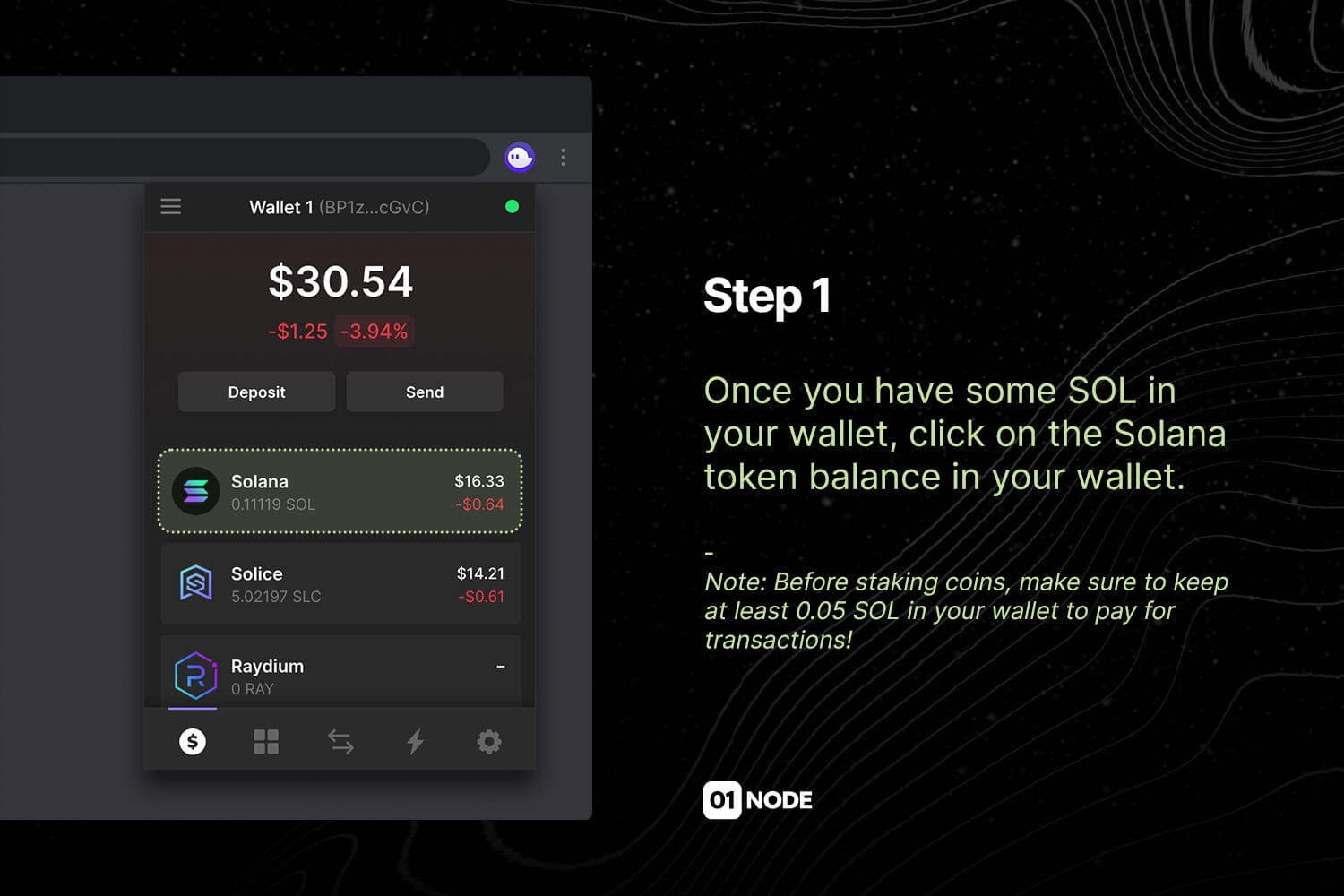

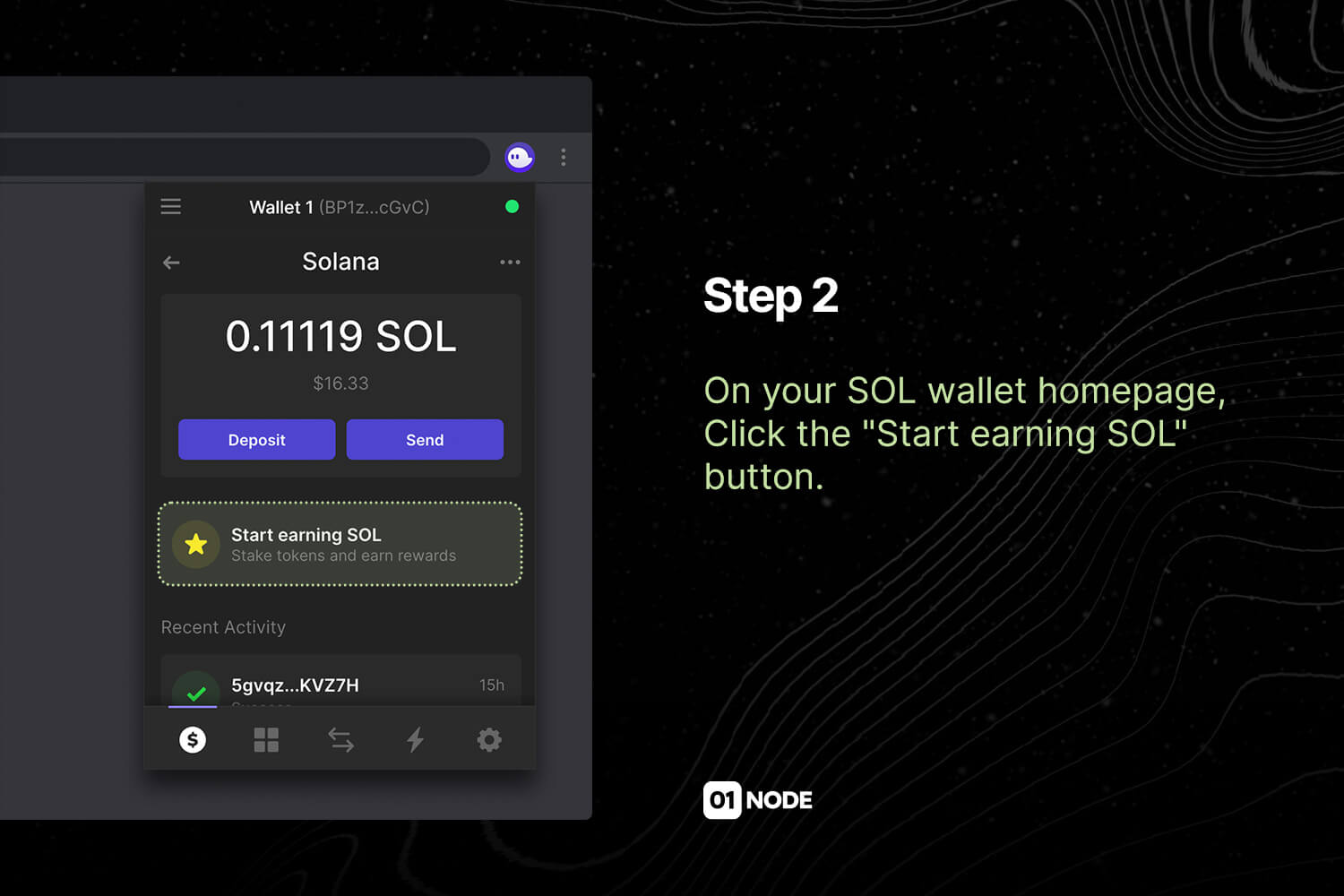

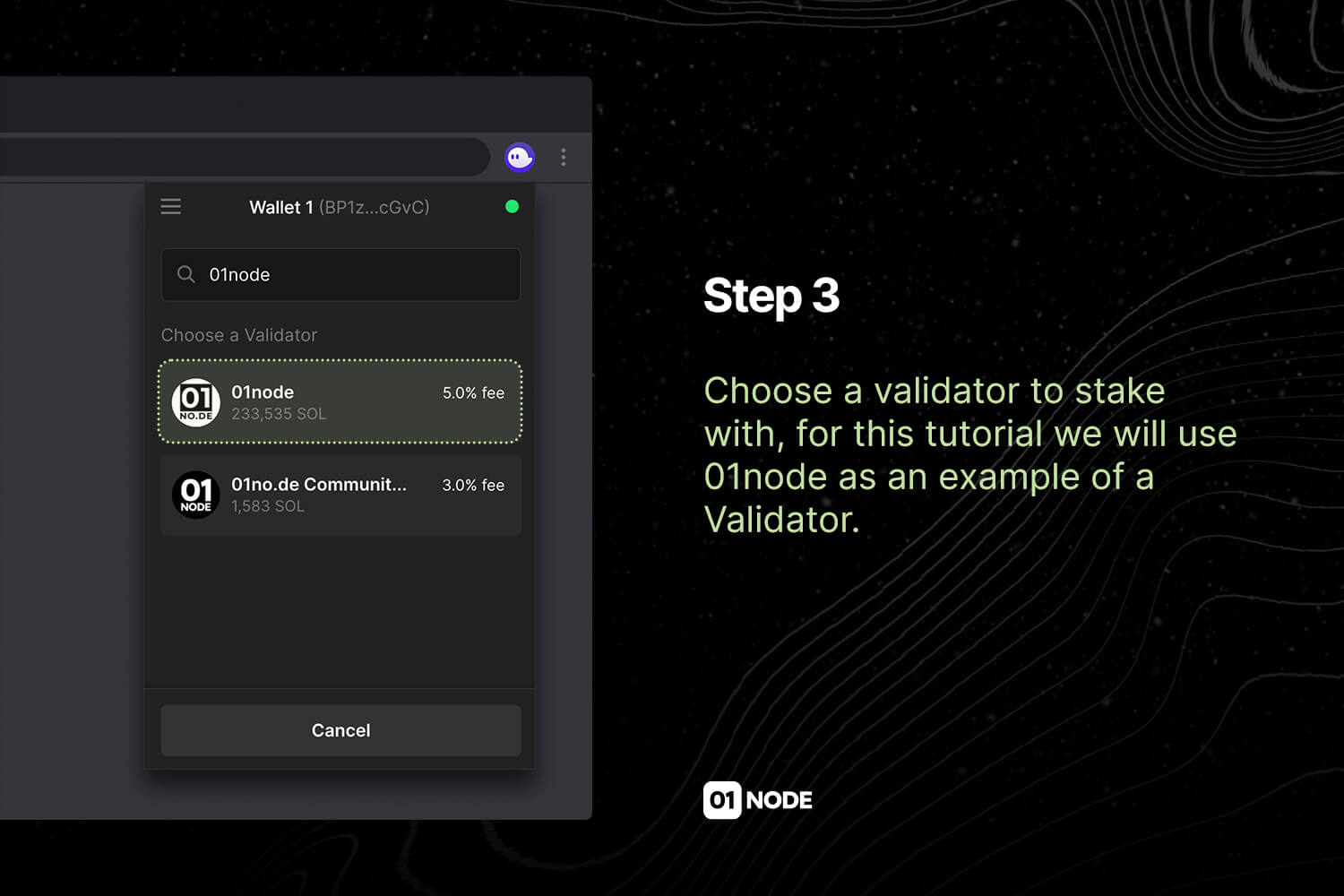

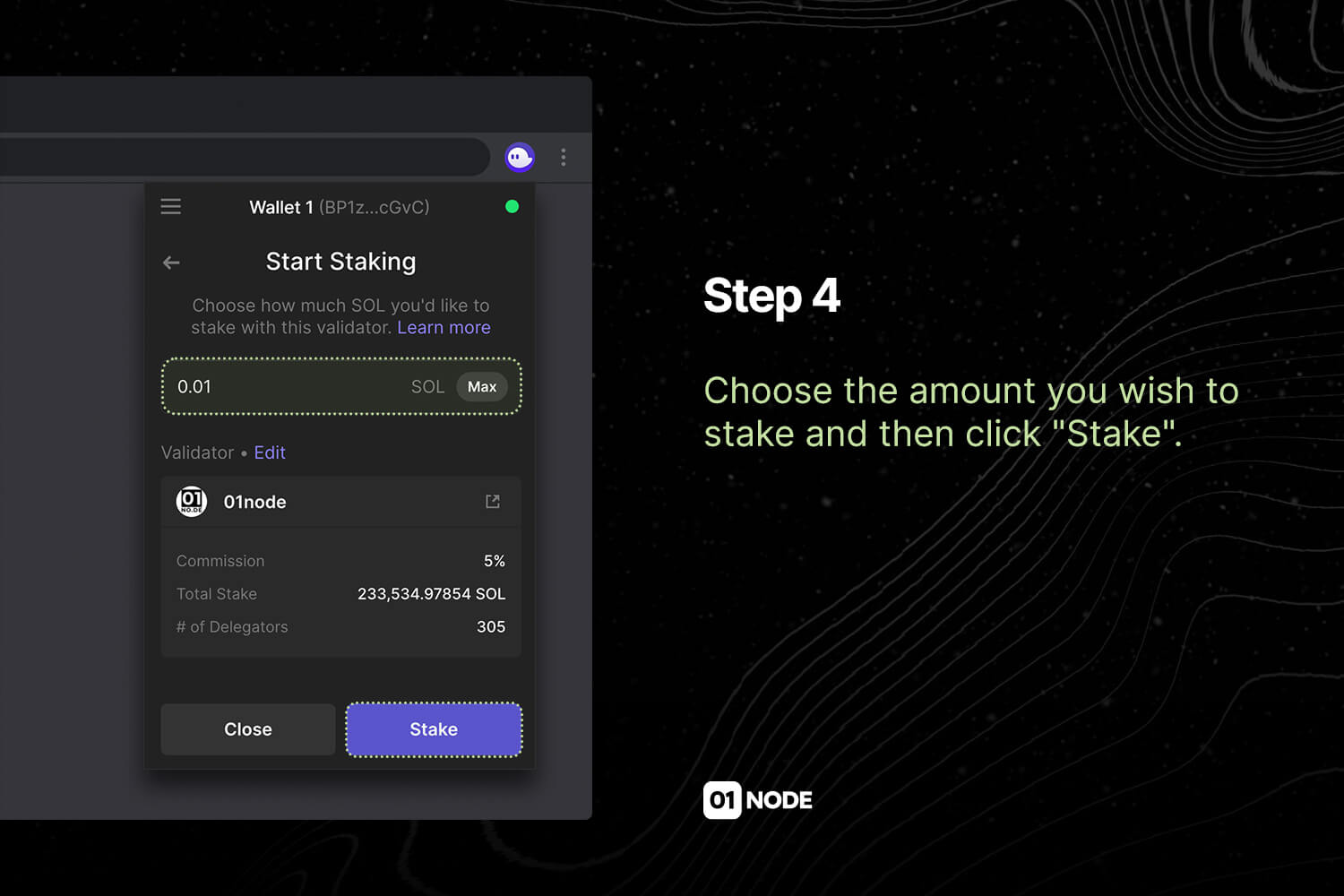

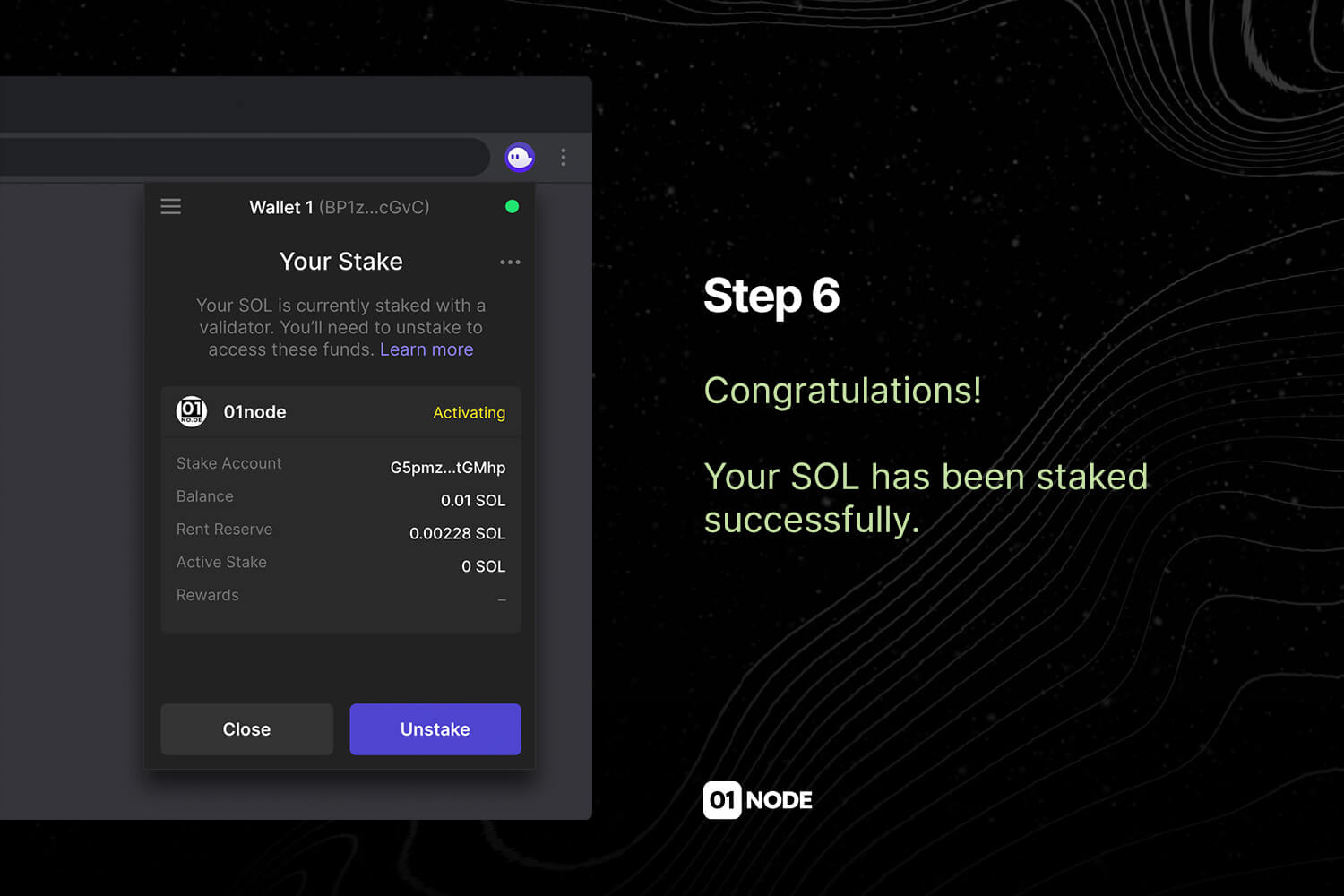

How to delegate SOL (staking)?

To stake SOL tokens, you must use a wallet that supports staking.

Not all wallets support staking at this time.

Is there min/max staking amount?

You can create as many stake accounts as you like, and deposit as much or as little SOL into each stake account as you want – no limitations.

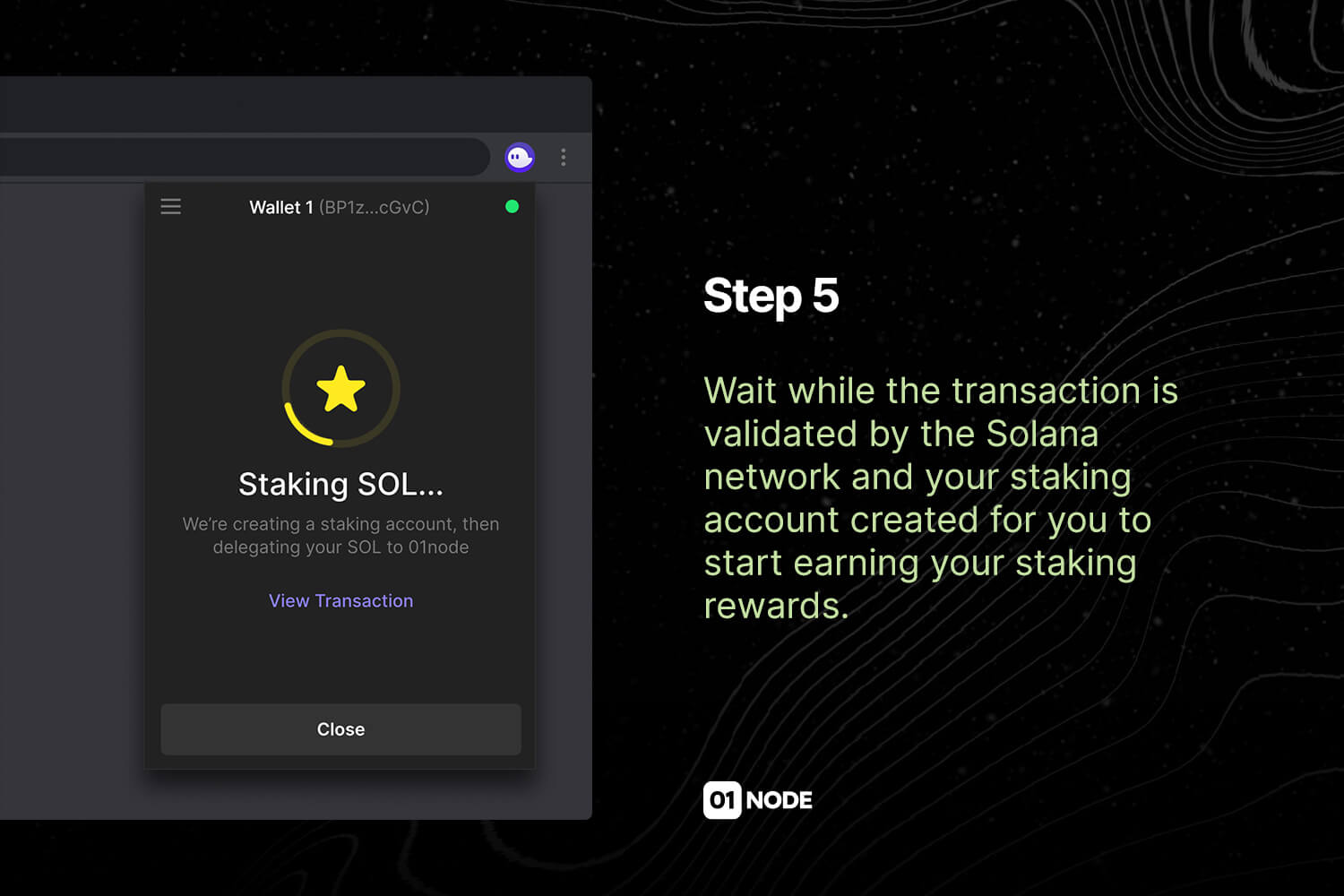

When will I receive my first staking rewards?

Newly delegated tokens are considered “activating” or “warming up”, and are not eligible to earn rewards until they are fully activated. Hence, you need to wait till the next epoch to start earning rewards.

⏱️ However, your wait might be extended to 2 epochs (or about 4 days).

Is there an unbonding period?

Newly un-delegated tokens are considered “deactivating” or “cooling down” and are not able to be withdrawn until deactivated at the epoch boundary. Once the stake is deactivated, withdraw tokens to start using them again.