Ever imagined a world where launching your own blockchain was as easy as a few simple steps? Yesterday, that imagination turned into reality with the launch of Celestia. But what makes Celestia so different? How does it manage to securely scale with the number of users while keeping crucial network resources free? The answer lies in its innovative approach to Modular data availability (DA) networks. Let’s dive into the dawn of this revolutionary network and uncover why it’s the talk of the town.

What is Celestia?

As the answer to today’s monolithic blockchains, Celestia is a modular data availability (DA) network that securely scales with the number of users, making it easy for anyone to launch their own blockchain. By focusing on transaction ordering and publishing, Celestia keeps the Consensus Layer separate from execution and settlement functions — freeing up crucial shared network resources.

Before diving into the specifics of Celestia and how it works, it’s important to first understand the benefits of modular blockchains and why there’s a need for them as we push the boundaries of blockchain technology.

What are modular blockchains?

Modular blockchains are a type of blockchain where developers can break down the components of the system into smaller, more manageable pieces. This allows them to easily customize and adjust any one aspect of the blockchain without needing to completely overhaul the entire network. By modularizing their blockchain, developers have greater control over how their system functions, allowing them to quickly adapt it to different scenarios and conditions.

Modular blockchains vs. Monolithic blockchains

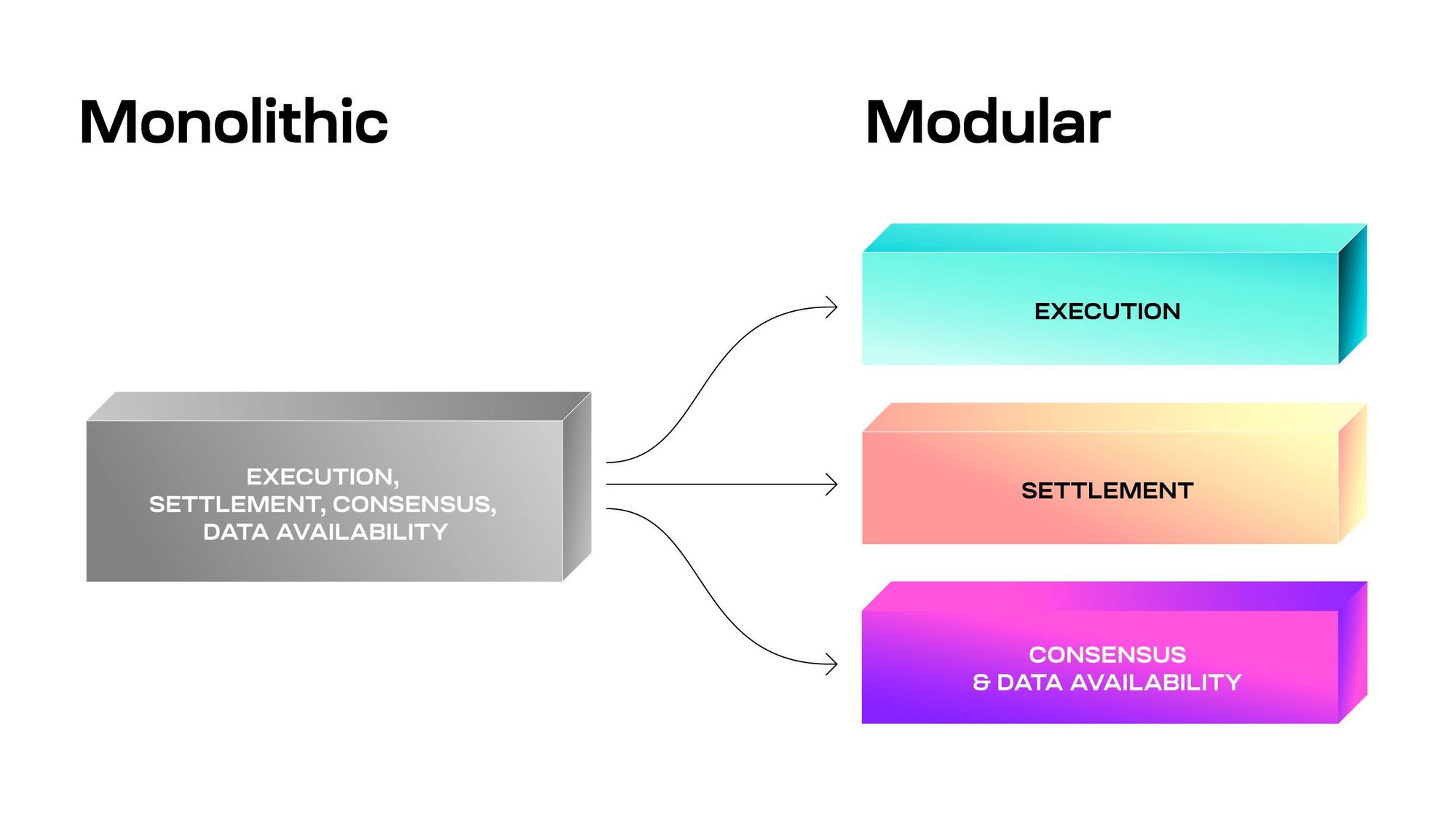

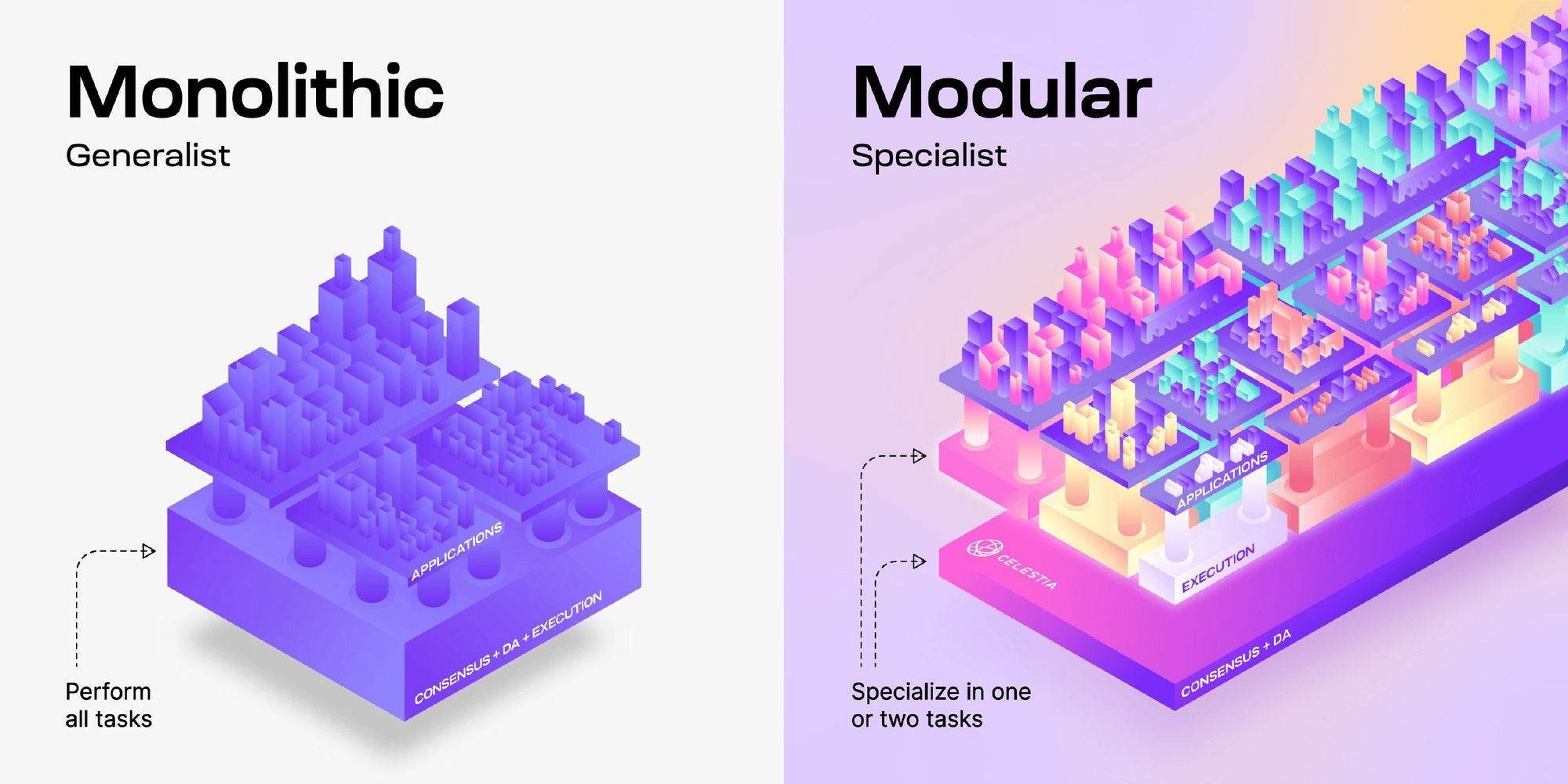

Curious about the differences between monolithic and modular blockchains? Essentially, monolithic blockchains have everything built on a single chain. This means all transactions have to go through one consensus mechanism and the size of data on it must stay within certain limits for it to function properly.

Conversely, modular blockchains offer more flexibility by separating the responsibilities of handling these various layers. Developers can choose between different modules to customize the execution, consensus, data availability, and settlement functions of their blockchain. This customization allows them to create specialized networks tailored for specific applications and use cases, while still keeping the core functionality of the blockchain intact. Overall, this makes modular blockchains the ideal option for organizations that need a reliable and efficient blockchain infrastructure that can easily be adjusted according to their needs.

Benefits of Modular Blockchain [ Celestia ]

Scalability

Remember, a core idea of modular blockchains is that they separate functions across multiple chains. This concept also brings extra scalability. A modular L1 like Celestia can now specialize in data availability. Without smart contracts, the L1 can focus all its resources on providing data for L2s, like rollups. Specialization is key because more data the L1 can provide allows rollups to process more transactions.

Shared security

Each time a new monolithic blockchain launches, a crucial part of the process is that they must bootstrap their own validator set. Unfortunately, it can be difficult to source a large enough validator set to become secure. Differences between chains leads to uneven security in an ecosystem of monolithic chains. A few will have high security with large validator sets, while many others will have low security with small validator sets. If we expect thousands of chains or more to make up the multi-chain ecosystem, we can’t expect each one of them to have enough security.

Sovereignty

When an app is built on a shared monolithic blockchain, it is bound by predetermined rules. The rules might be around social consensus (when it’s okay to hard fork) or around technical rules (what programming languages you can write smart contracts in).

Modular blockchains enable control over the rules of an application through sovereignty. Developers can make changes to the tech stack without permission from outside applications. For example, they could make a more performant execution environment or change how transaction processing works – who wants parallel transactions?

Why is Celestia so popular: the Celestia airdrop

Since the project began in 2019, crypto traders and enthusiasts have long been excited about Celestia’s token launch. This has only been magnified by the hotly anticipated Celestia airdrop, where 60,000,000 TIA tokens are being distributed to a wide range of active users across blockchain networks. This Genesis Drop has certainly amplified that excitement about Celestia being the next big thing in the crypto space and will include the following users:

- Top 50% of active users of the top 10 Ethereum rollups by TVL, with a balance of at least $50 based on a snapshot taken on 1 January, 2023. Eligible rollups include but aren’t limited to Optimism Mainnet, Arbitrum One, Arbitrum Nova, Starknet, and Loopring.

- Cosmos Hub and Osmosis stakers and delegators of at least $75 based on a snapshot taken on 1 January, 2023.

- Various public GitHub contributors to the Celestia codebase across Modular Summits and Celestia’s Modular Fellows program.

It was distributed yesterday, hope you got yours!

What is TIA: understanding TIA token utility

As the native token of the Celestia blockchain, TIA is an essential part of how developers will build on Celestia and use it for data availability. According to Celestia’s white paper, TIA tokens will have the following uses:

Bootstrapping new rollups

A core tenet of Celestia’s vision is blockchain deployment simplification such that anyone can effortlessly launch and deploy their own blockchain. With TIA tokens, developers won’t need to issue tokens to complement their blockchain’s launch. Like ETH on Ethereum-based rollups, developers can choose to bootstrap their chain quickly by using TIA as a gas token and currency. In doing so, developers can instead focus on creating their application or execution layer without fretting about token creation and issuance.

Paying for blobspace

TIA tokens are key to how developers build and interact with Celestia. To publish data on Celestia and use it for data availability, rollup developers submit PayForBlobs transactions, which consist of typical transaction information like sender identity, the data to be made available, the data size, the namespace, and a signature. These transactions will require a fee, which is paid for in TIA tokens.

Staking rewards

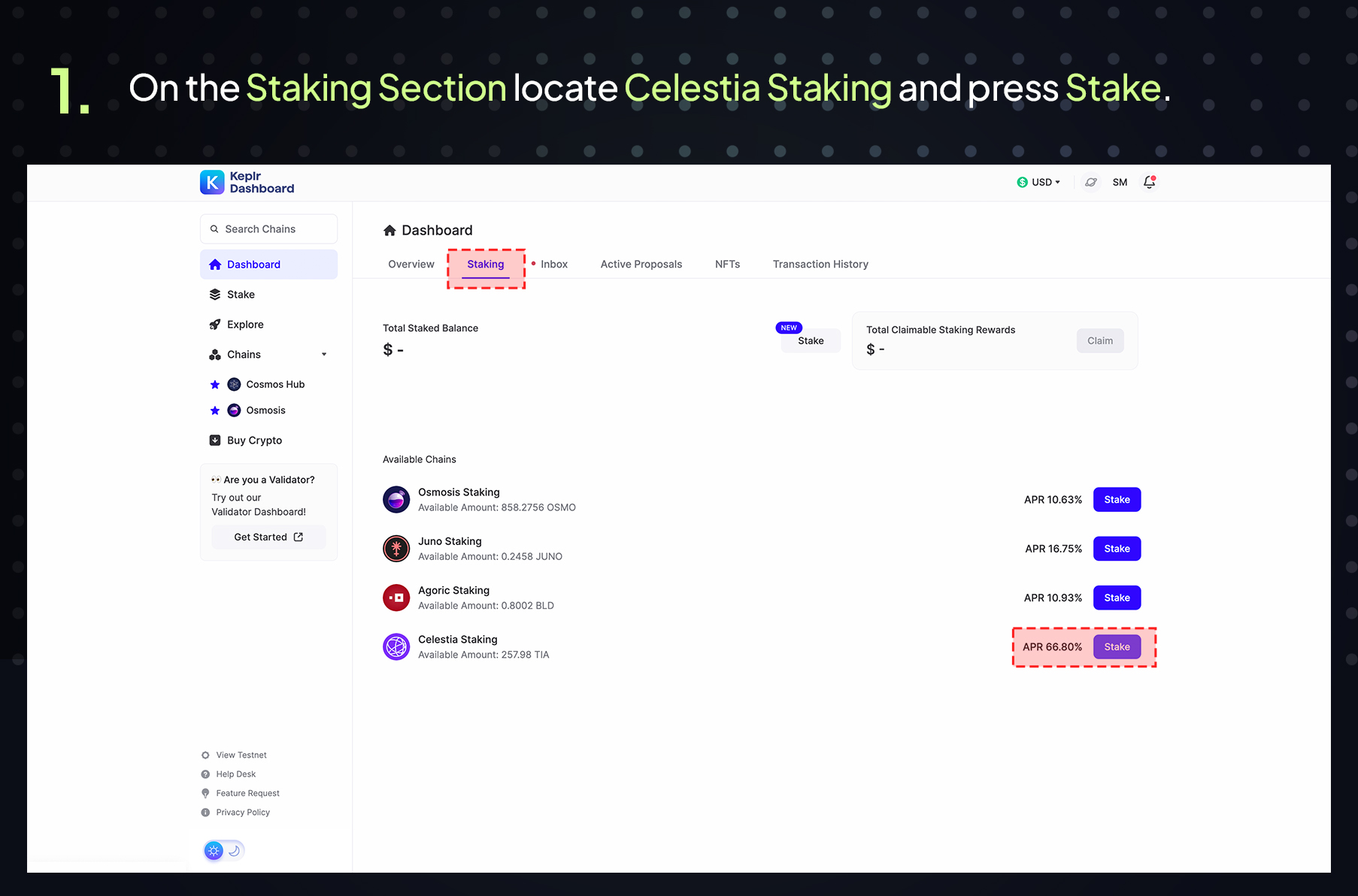

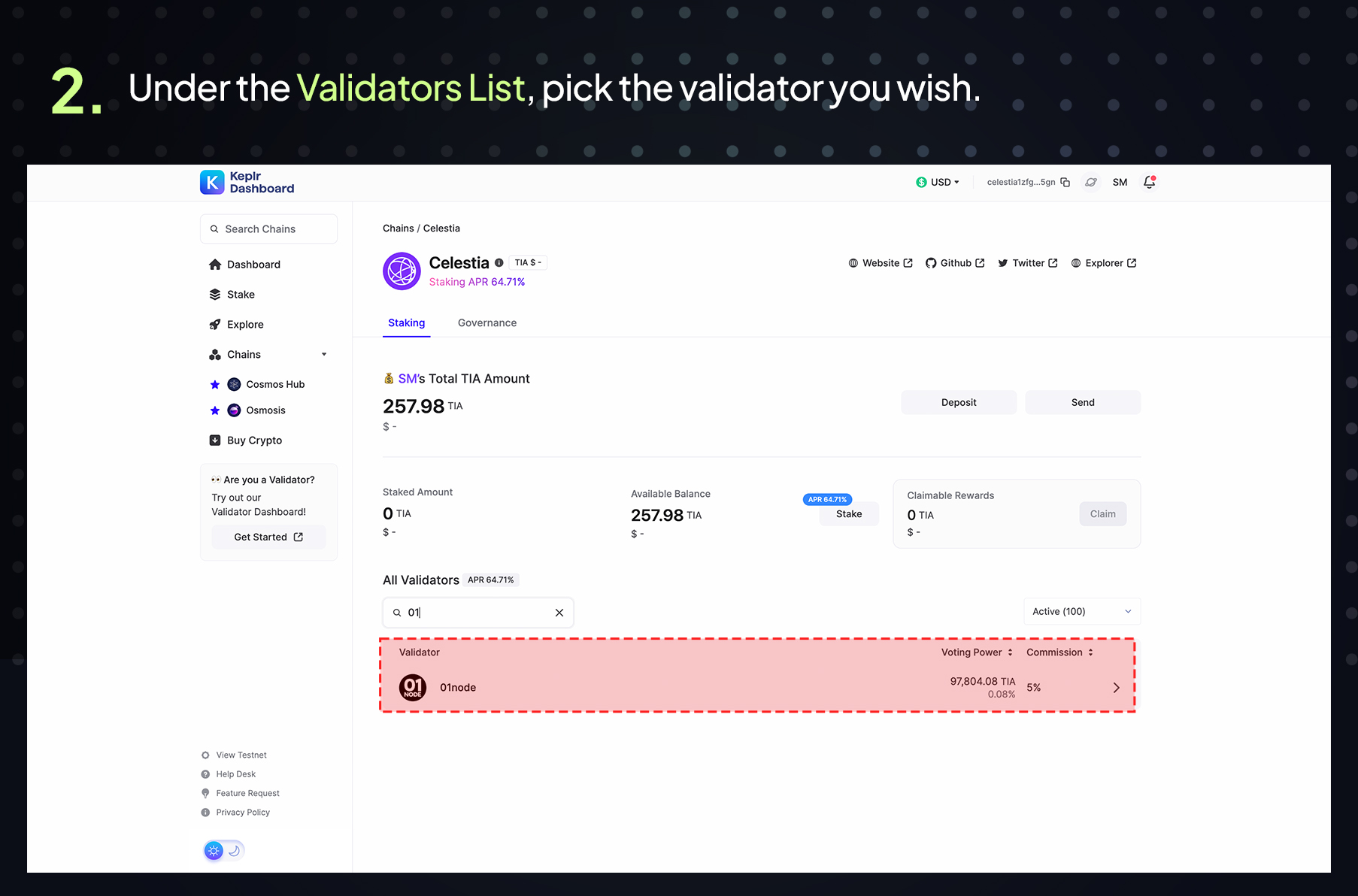

As a permissionless network based on CometBFT and the Cosmos SDK, Celestia uses the proof-of-stake consensus mechanism to secure its network. Like in other Cosmos networks, users can help secure the network by delegating their TIA tokens to a Celestia validator for a portion of their validator’s staking rewards. Notably, Celestia supports in-protocol delegation and will start with an initial validator set of 100.

If you are interested in putting your $TIA to work and earn rewards from it, then staking is for you: STAKING LINK.

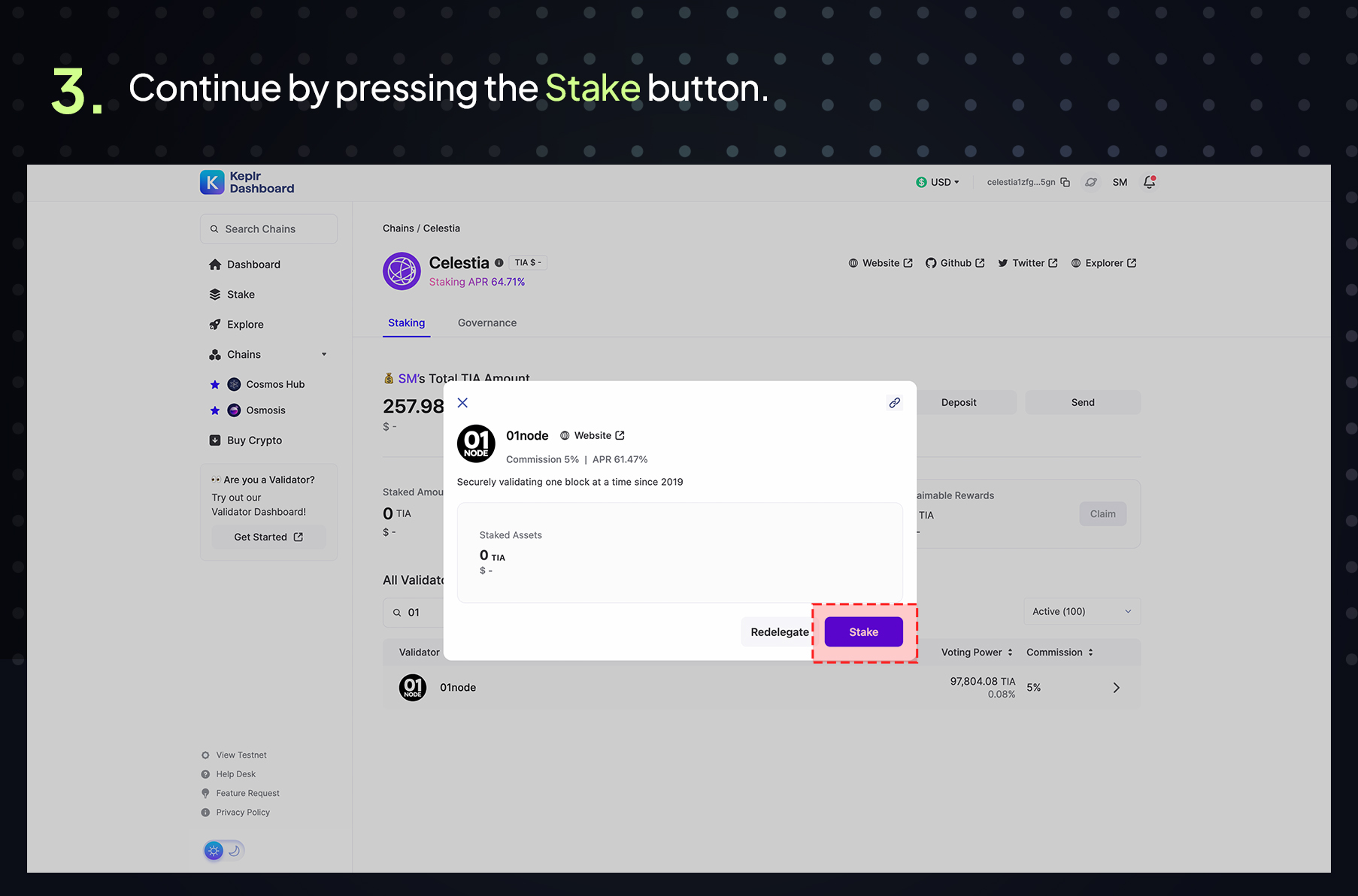

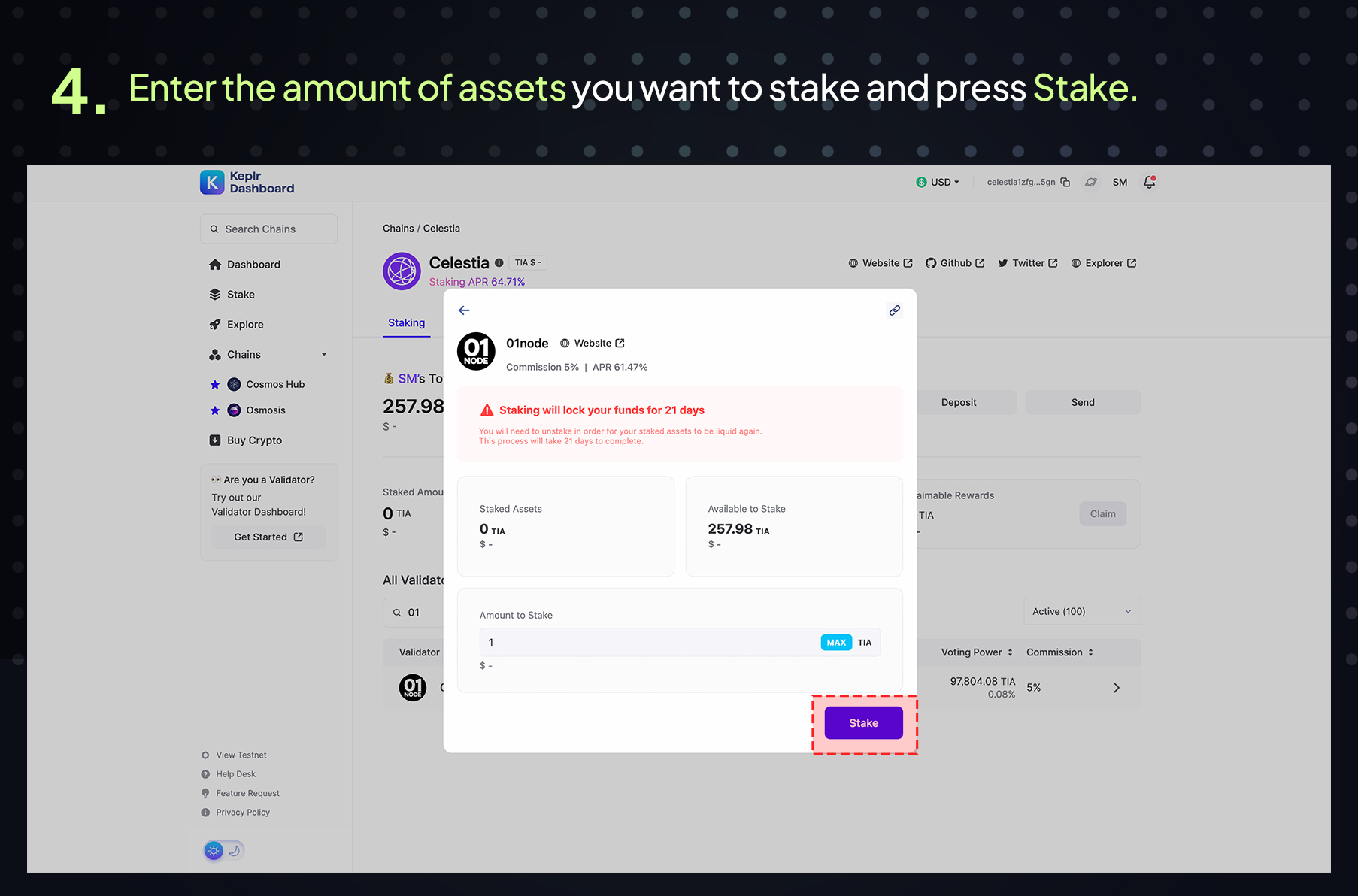

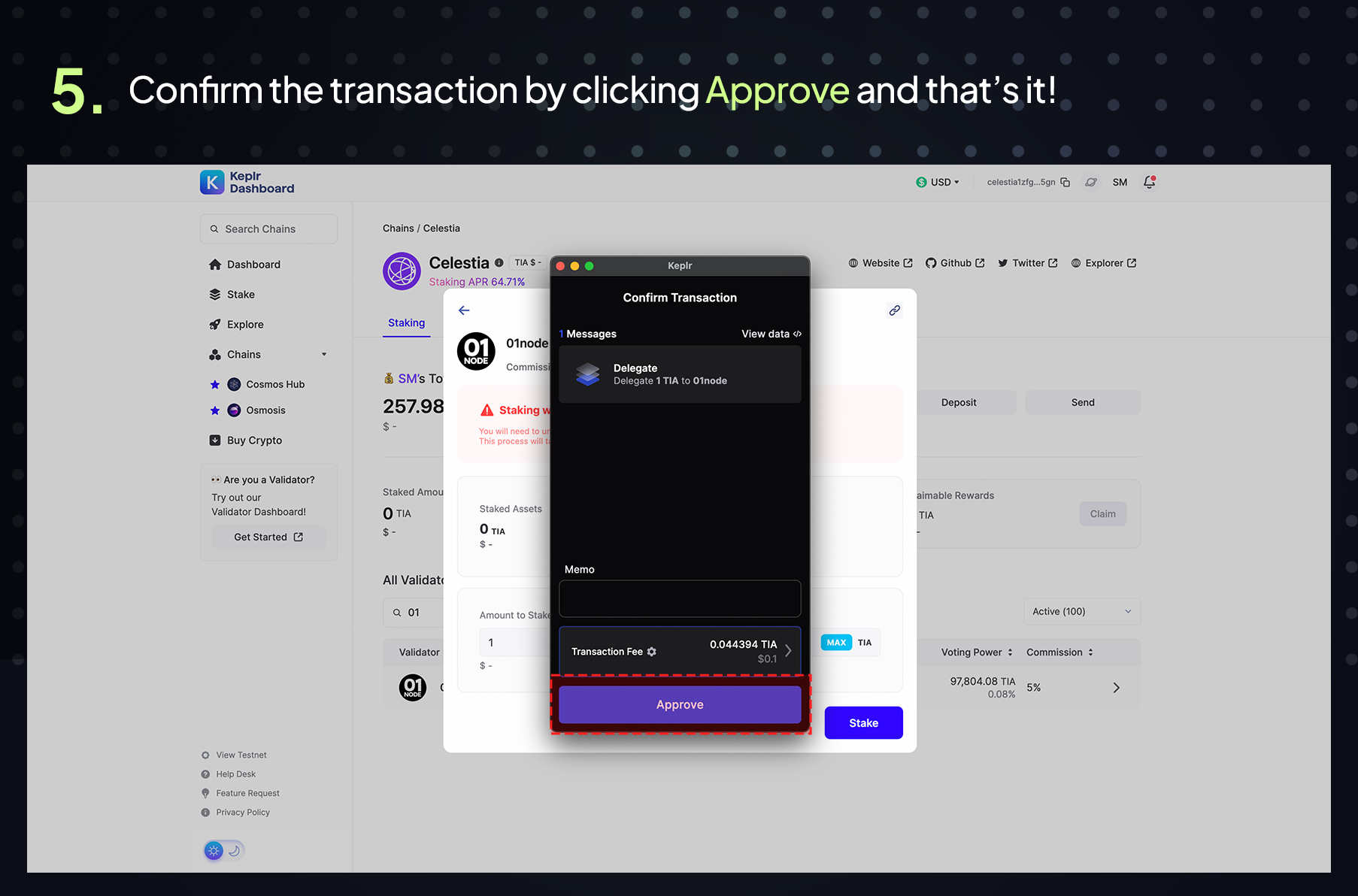

How to stake $TIA

Decentralized governance

Centralization among founding developers can be a red flag for many blockchain projects. Fortunately, Celestia leans towards decentralized governance regarding overall decision making. Unlike some governance tokens which require staking to unlock voting rights, users simply need to hold TIA tokens to have the right to vote and submit governance proposals to alter existing network parameters, fund ecosystem initiatives, and manage the community pool. Said pool will also receive 2% of all Celestia block rewards.

TIA tokenomics

Has Celestia’s TIA token piqued your interest? Here are some tokenomics to keep in mind:

- TIA will have a total supply of 1,000,000,000 and an initial circulating supply of 14.1% (141,000,000 TIA).

- 20% of TIA’s total supply is allocated to the public and will be used for Celestia’s testnet incentives and future initiatives.

- TIA tokens will have an inflation schedule of 8% in the first year and a subsequent decrease of 10% per year until reaching an inflation floor of 1.5% annually.