What is Quicksilver?

Quicksilver is a permissionless, sovereign Cosmos SDK zone providing liquid staking for the entire Interchain ecosystem.

The Quicksilver Protocol allows delegators of proof-of-stake network stake assets against any validator running on IBC-enabled chains. In turn, delegators receive derivative vouchers representative of their staking positions. Built using the Cosmos SDK, Quicksilver provides Interchain Liquid Staking that scales to all validators across the network of IBC-connected chains while preserving users’ governance rights. It maximizes liquidity and capital efficiency while simultaneously improving network security and decentralization.

Through Quicksilver, users receive qAsset vouchers, representative of their staked asset, which, in turn, can then be used in DeFi protocols. Quicksilver can scale seamlessly to any IBC-connected chain, and users participating in the protocol can delegate to any validator of their choosing and retain their voting rights through the protocol’s Governance by Proxy feature.

Quicksilver empowers users and provides them with a smooth UX, all while maintaining chain security and decentralization.

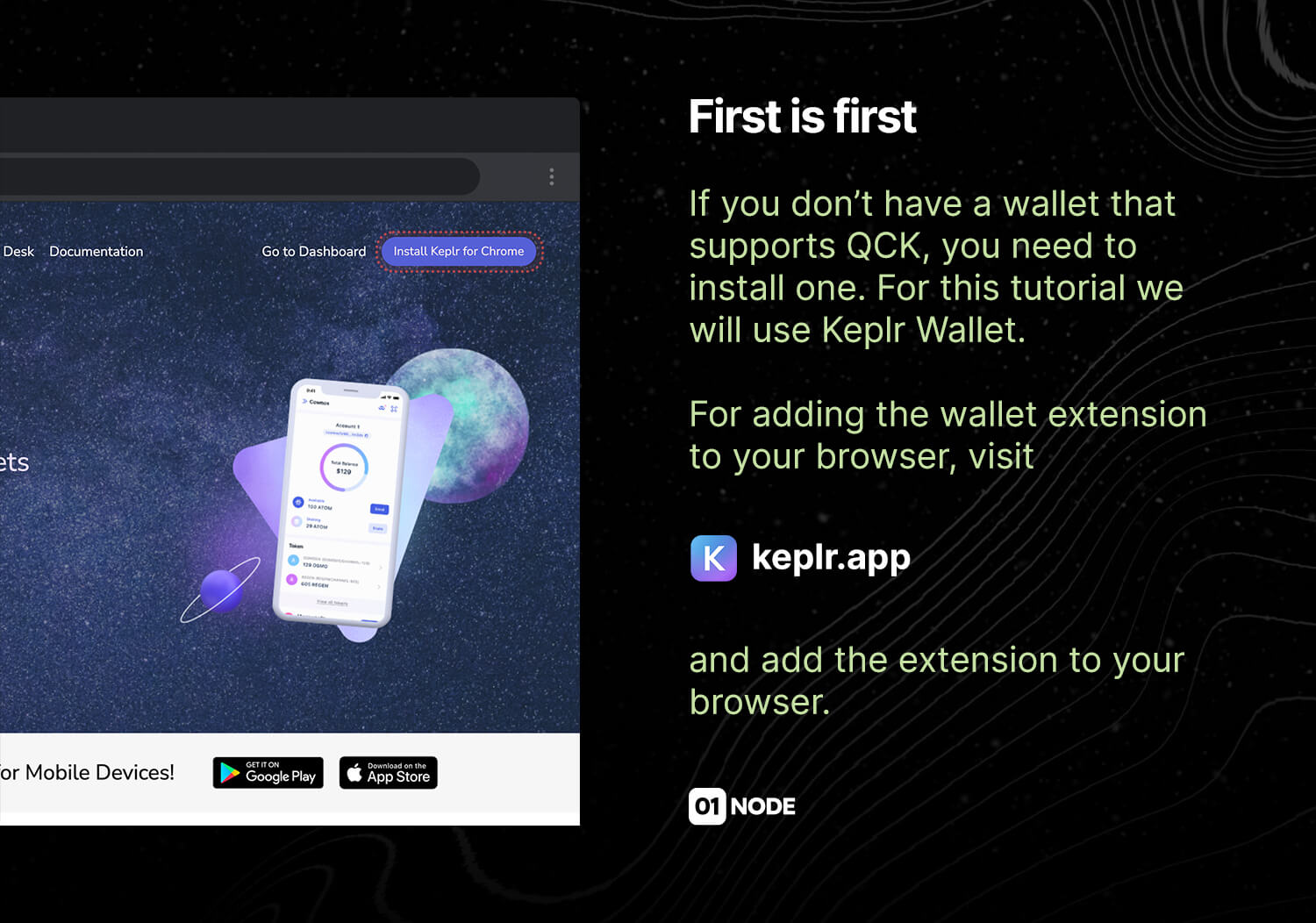

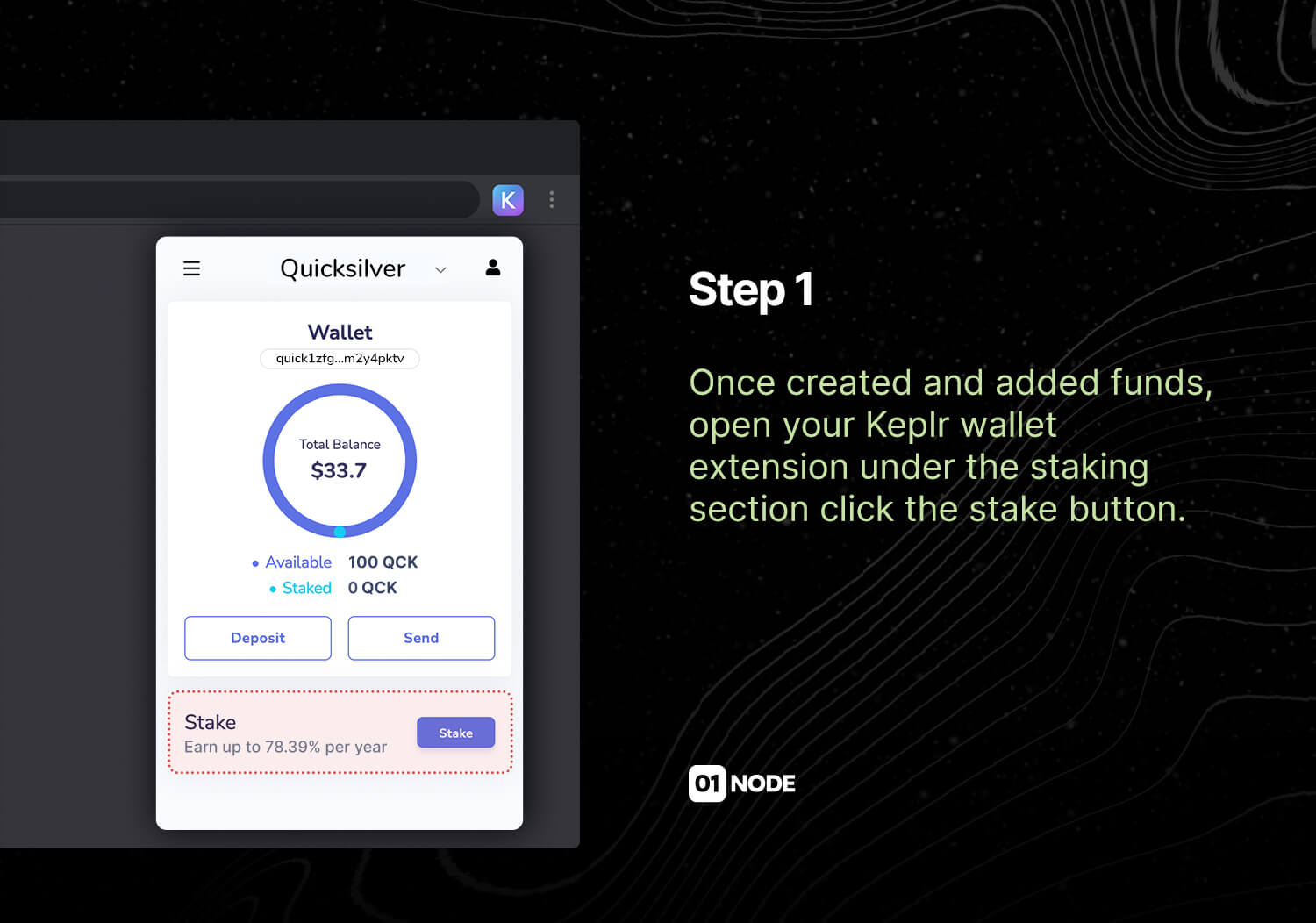

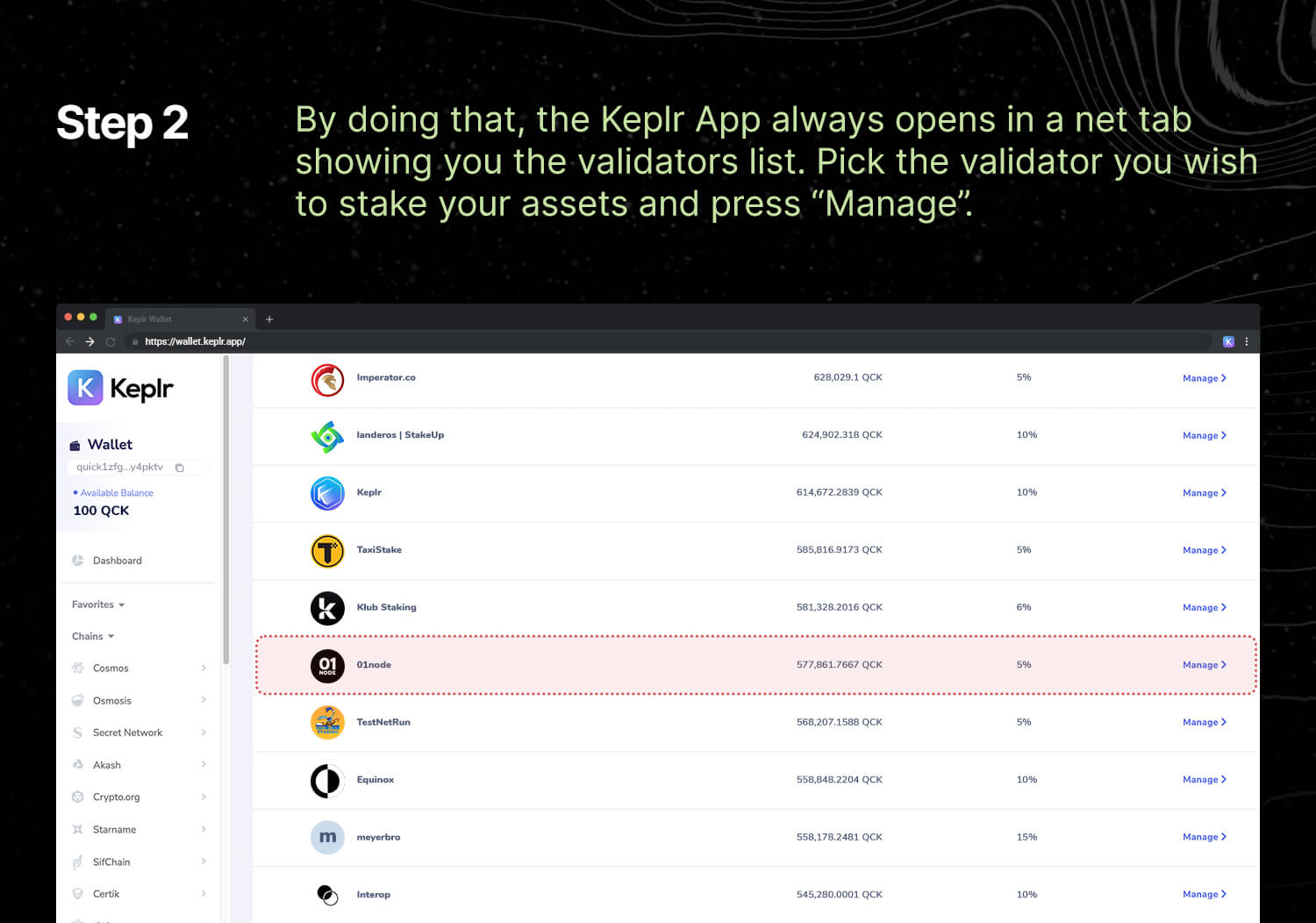

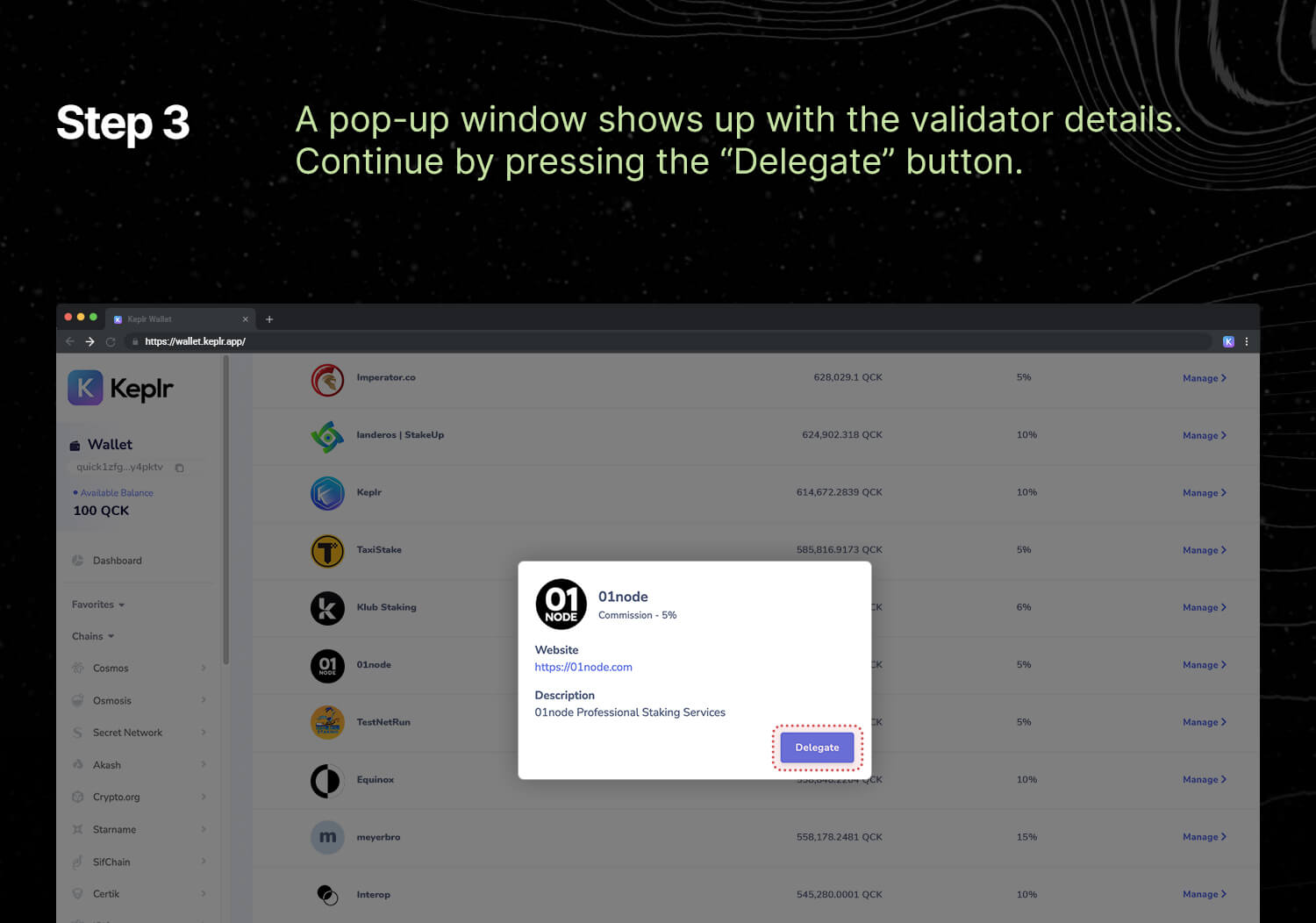

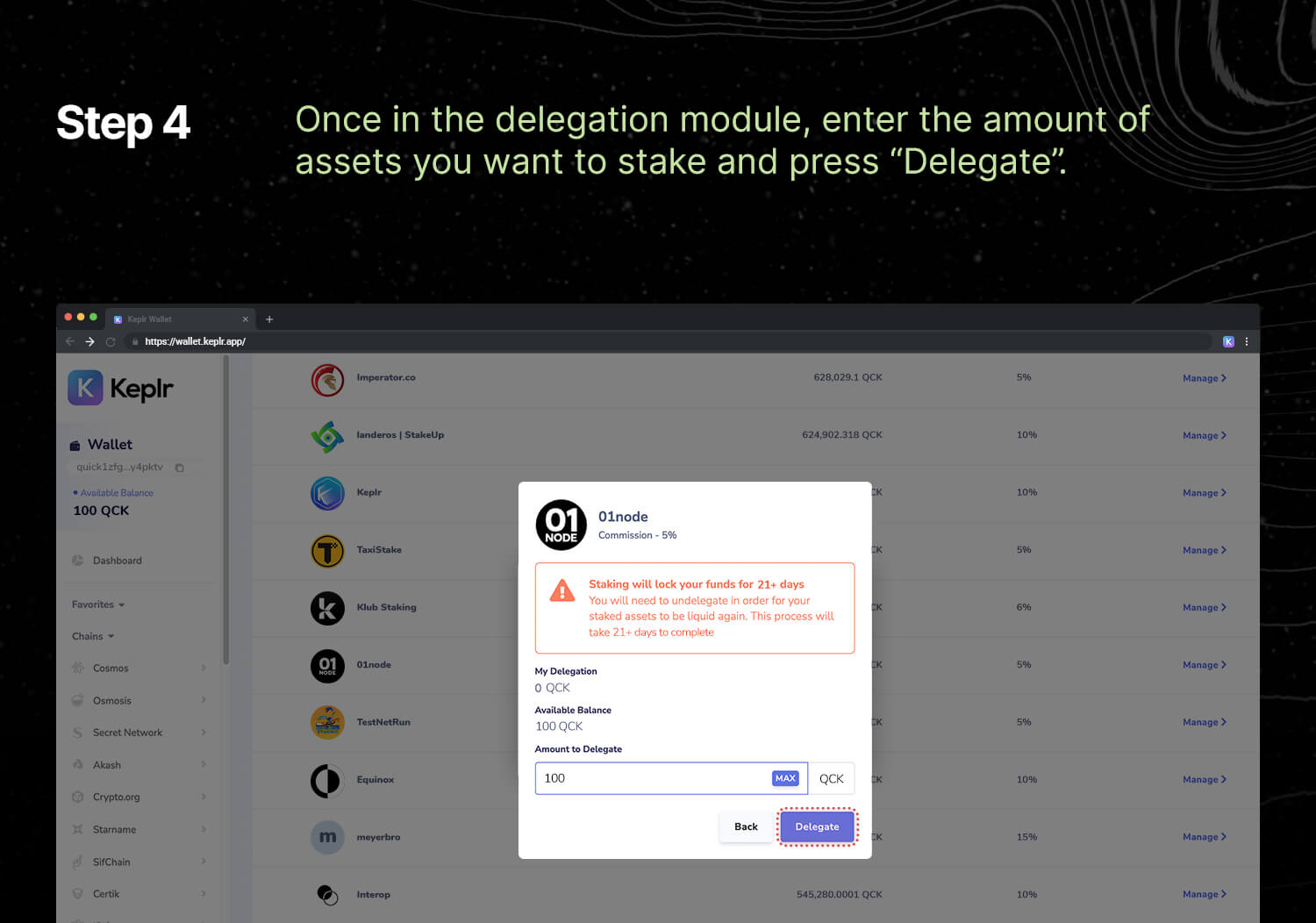

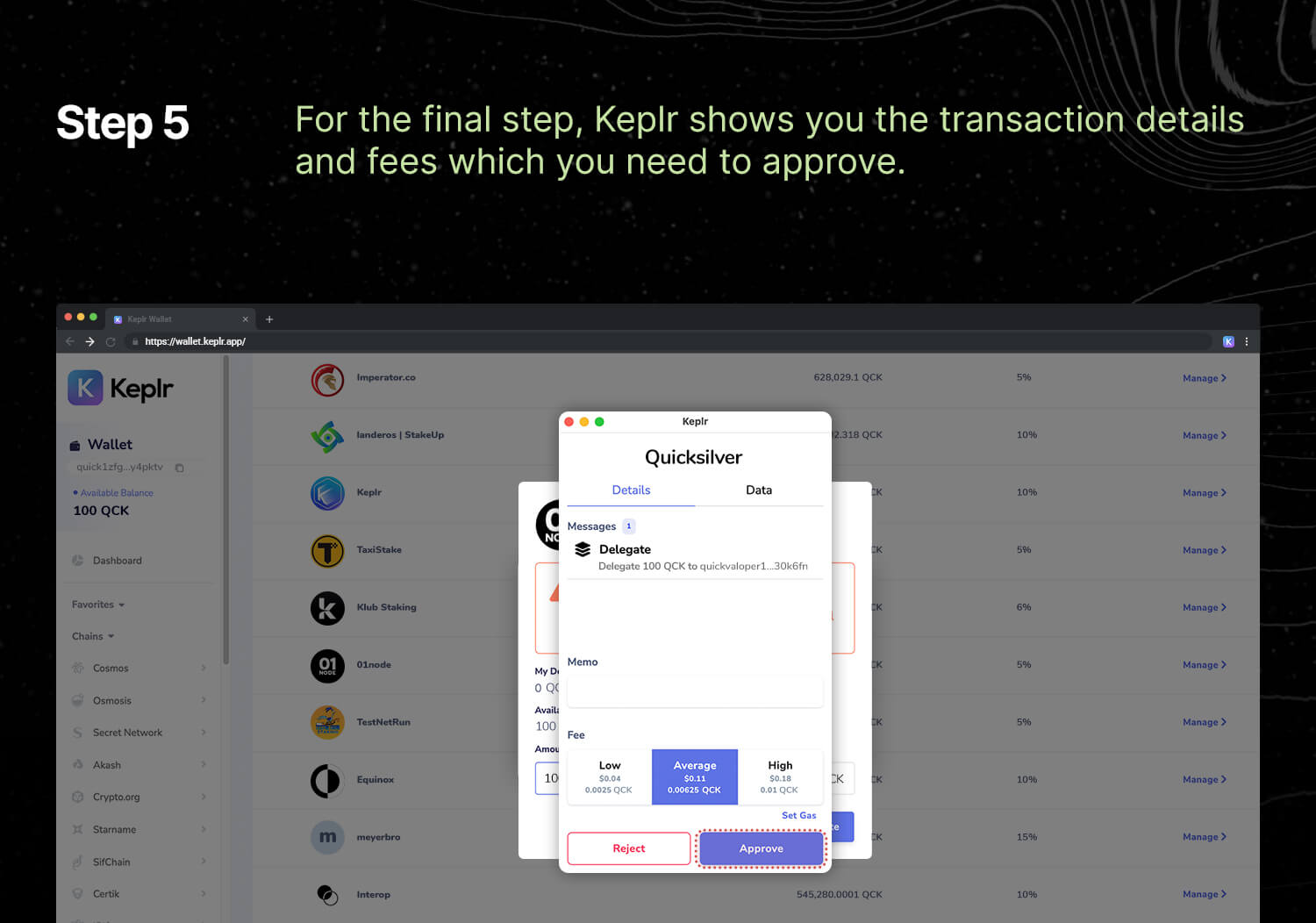

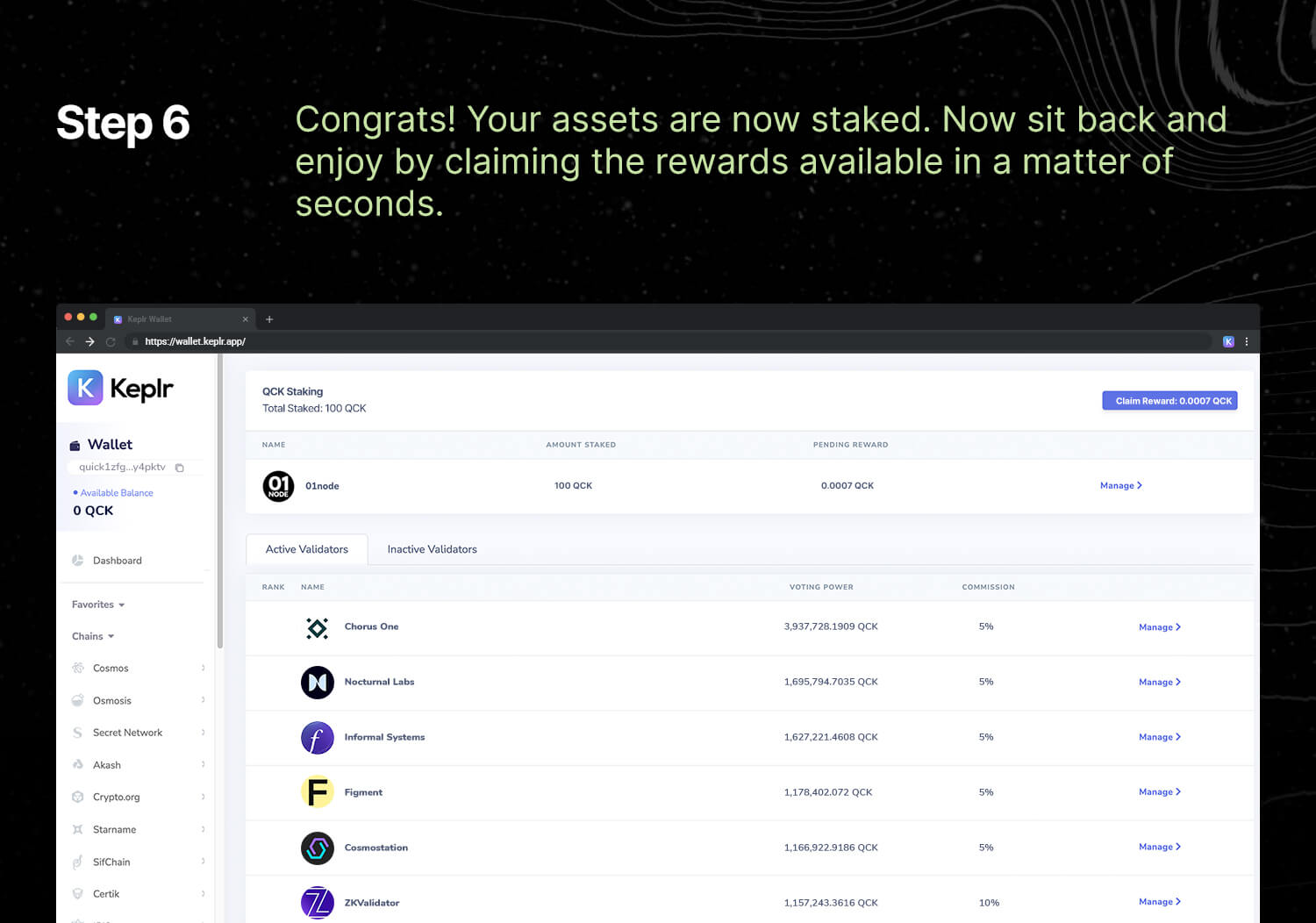

How to stake QCK

Architecture

The Quicksilver Protocol increases capital efficiency by delegating tokens on behalf of users and, in turn, minting a tokenized representation of the user’s delegation, herein referred to as a qAsset. The qAsset takes the form of the onboarded zone’s native asset prefixed with q, for example, qAtom or qOsmo.

qAssets are liquid, fungible, and transferrable via an IBC transaction away from the Quicksilver zone. The underlying value of the qAsset is that of the native bonded asset, plus any staking rewards earned since minting, minus any potential slashing. As such, the pricing of the qAsset is expected to increase in value over time relative to the original bonded asset, as risk remains largely constant and rewards increase over time.