The leading decentralized Cosmos exchange

What is Osmosis (OSMO)?

Osmosis is a decentralized exchange (DEX) and a cross-chain automated market maker (AMM) protocol built for the Cosmos ecosystem, with plans to expand to more blockchains.

To better understand osmosis, It will be helpful to first understand the Cosmos ecosystem and learn some DeFi & DEX fundamentals in order to fully grasp the Osmosis value proposition.

Cosmos: Cosmos is an “Internet of Blockchains” network in which developers can build interoperable dApps. In the ideal Cosmos world, Ethereum apps will play nicely with Binance Smart Chain apps, and so on. But for now, projects that adhere to the IBC will be able to seamlessly communicate with each other and send tokens with minimal transaction fees.

The Inter-Blockchain Communication Protocol (IBC) : IBC is a protocol that relays messages between various independent distributed ledgers. It functions as a bridge that connects various blockchains in the cosmos ecosystem and It was initially created to connect Tendermint‐based blockchains.

Tendermint Core is a Byzantine-Fault Tolerant engine for building blockchains. It allows developers to write their applications in any language, and then replicate the app globally. There is no need to wait for transaction confirmations; a transaction is immediately finalized once included in a block.

Automated Market Maker (AMM): This popular DEX protocol relies on algorithms to price cryptocurrency assets in liquidity pools, filling the role of a centralized market maker in an order-book method platform.

Two essential components of the Cosmos (and Osmosis) goal are sovereignty and heterogeneity, and you can find echoes of these concepts in practically every feature.

Osmosis Features

The Osmosis AMM

Osmosis is a DEX protocol, which implies that it makes use of smart contracts to set the price of digital assets, provide liquidity using a peer-to-peer (P2P) system, and execute trades between users. This method of operating an exchange platform is referred to as an AMM; it is a DEX protocol that values cryptocurrency assets in liquidity pools. Decentralized liquidity is promoted by adding tokens to these pools, and this liquidity is then utilized to assist trading on the exchange. Trading commissions and newly created LP tokens can be obtained as rewards for taking part as a liquidity provider (LP).

The Osmosis AMM is distinctive in that it gives customers the option to design their own liquidity pools or clone pre-existing ones with customized settings. Users are able to natively trade assets from more than 47 distinct chains within Cosmos because Osmosis is based on the Cosmos ecosystem.

Cross-chain Native

Osmosis is designed to be cross-chain native, and like many Cosmos projects, it’s built to be IBC compatible at its foundation.

Osmosis has branched out to non-IBC enabled chains, such as Ethereum-based ERC20s (via the Althea gravity bridge), Bitcoin-like chains, and alternative smart contracting platforms (via custom pegs).

Osmosis provides cross-chain liquidity through Axelar which enables that liquidity to move beyond the Cosmos ecosystem quickly, cheaply, and, above all, securely.

No competing cross-chain liquidity service provider can offer Osmosis and Axelar’s combination of decentralization, safety and liveness guarantees, low latency, deep liquidity, and ease of integration.

Sovereignty and Integrated Incentivization

The Cosmos ecosystem values sovereignty highly. Osmosis derives its sovereignty from its architecture as well as the collective sovereignty of liquidity providers – each LP is incentivized to maintain their autonomy while also providing liquidity through various mechanisms.

Osmosis is unique in the Cosmos ecosystem (and other DEXes) because it aligns the interests of liquidity providers, DAO members, and delegators with a variety of incentives. Staked liquidity providers, for example, have sovereign ownership of their pools and can adjust parameters based on market conditions and how competitive the pool is, among other things. Nothing in the Osmosis AMM is hardcoded; LP providers can vote to change any pool parameter, including swap fees, token rates, reward incentives, and curve algorithms.

Liquidity pools on Osmosis are self-governing, and completely customizable through their governance.

With the aim of fostering a competitive environment that encourages quick iterations and experiments, this feature encourages variety. A wide range of customization options are used to create this heterogeneity. Osmosis supports dynamic modifications of exchange fees, multi-token liquidity pools, and custom-curve AMMs in contrast to other DEXes, which rely on bonding curves. The Cosmos AMM can theoretically support interchain staking, a decentralized token market, and an options market.

SuperFluid Staking

Token holders in the traditional DeFi industry must choose between generating yield from staking (which helps to keep the protocol running) and generating yield from liquidity (which provides AMM stability).

Osmosis pioneered a feature known as Superfluid Staking, in which OSMO (the Osmosis governance token) can be used for both staking and liquidity at the same time, maximizing rewards while minimizing internal network tradeoffs (i.e., security for liquidity.)

So, in Osmosis, a liquidity provider or staker earns rewards for both providing liquidity and staking, whereas other platforms require token holders to make a tradeoff.

Superfluid staking allows Osmosis liquidity providers to stake the OSMO in their LP shares (GAMM). Because superfluid staking adds to the security of the chain, superfluid positions also earn staking rewards on top of the usual fees and liquidity mining incentives.

Example: If you added $1000 to the ATOM/OSMO pool, you would be providing $500 of OSMO and $500 ATOM (it is a 50/50 pool). To superfluid stake, you would first select the 14-day unbonding period, which currently yields liquidity mining incentives of ≈75% APR on your $1000. Then, you would elect to superfluid stake, which would give you an additional staking APR of ≈78% on the OSMO.

Osmosis OSMO Staking

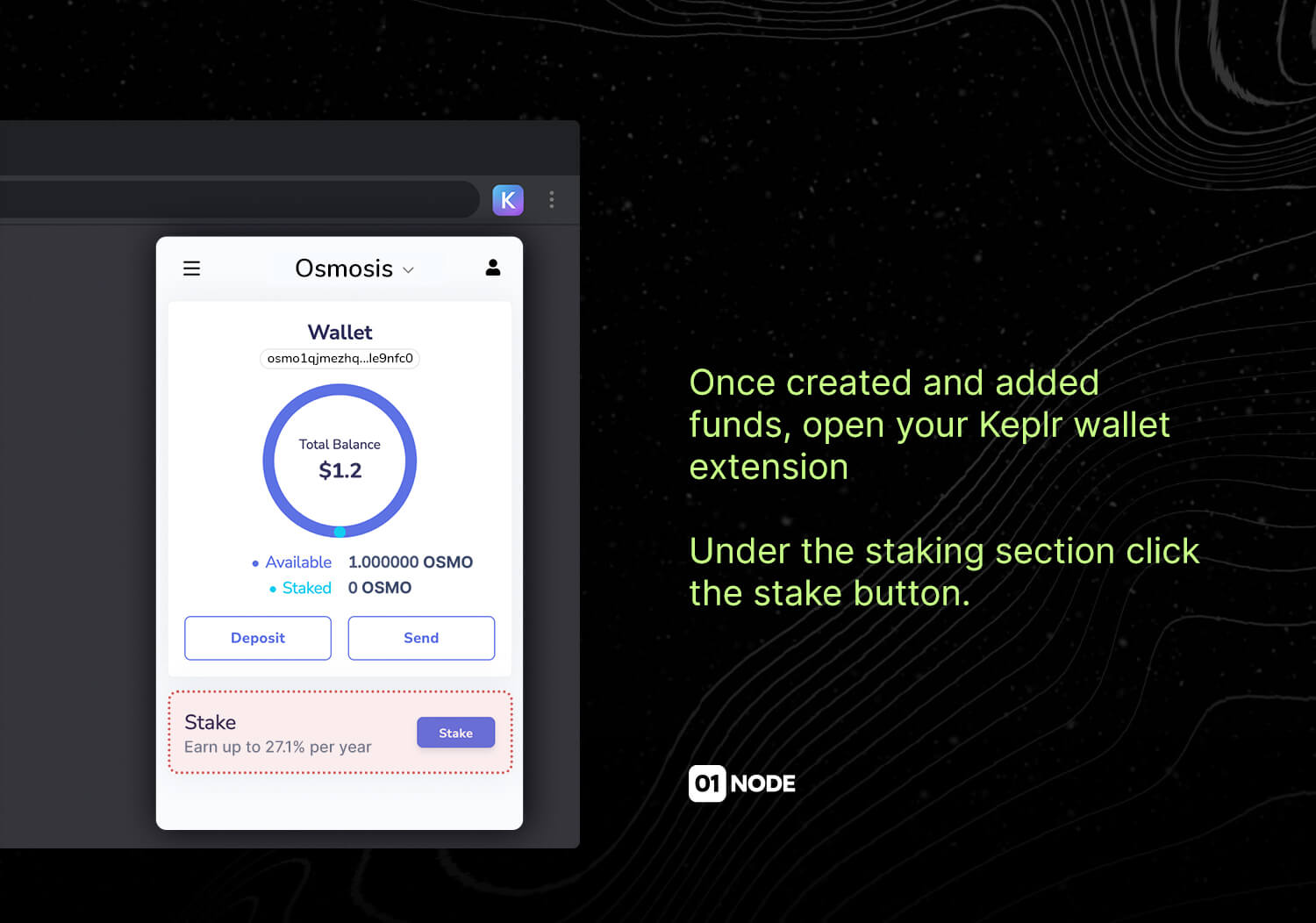

Staking can be done through Keplr, the primary wallet for the Cosmos ecosystem and Osmosis project.

$OSMO, the Osmosis Governance Token

OSMO is the native Osmosis token, and it underpins the entire Osmosis protocol, and it facilitates everything from liquidity mining reward allocation and the base network swap fee.

As a governance token, OSMO enables holders to decide the strategic direction of the project. It can be used to vote on upgrades to the protocol, allocate liquidity mining rewards for specific liquidity pools, and set the base network swap fee.

OSMO token holders determine which pools are eligible for liquidity rewards with the goal of aligning stakeholders and LPs with the longevity of the protocol.

OSMO is unique in that it can be used to stake and provide liquidity at the same time.

The OSMO tokenomics are as follows:

At genesis, an initial supply of 100 million OSMO, split between Fairdrop recipients and strategic reserve.

Osmos has events in which new tokens are released called “daily epochs.” The newly released tokens are distributed as follows:

- Staking Rewards: 25%

- Developer Vesting: 25%

- Liquidity Mining Incentives: 45%

- Community Pool: 5%

How to Use Osmosis

There are a few ways to use Osmosis, and it’s best to follow the money. There are three categories of fees on Osmosis:

- Anyone who transacts on the chain will pay transaction fees. These fees are variable and based on the storage and computation costs, and the minimum gas cost proposed. These fees are distributed to OSMO stakers and validator operators.

- Anyone who swaps assets on the DEX will pay swap fees, which are determined by each liquidity pool’s parameters and trade size. These fees are distributed pro-rata to that pool’s liquidity providers.

- Liquidity providers who pull their liquidity out of a pool will pay exit fees. The LP shares are then burned, and the value is distributed to the remaining liquidity providers.

So, anyone can use the Osmosis DEX functionality to swap IBC-compatible tokens like ATOM, ION, AKT, and other compatible chains like CRO.

About 01node

01node is a high quality staking and validation service headquartered in Romania. We have the expertise and time tested infrastructure as a highly secure and reliable node. Our track record shows this reliability, We prioritize great focus on security and we ensure the best practices for every service we offer. We aim to provide the best performance and reliability through our physical infrastructure collocated in tier-3 datacenters.

We are a team of highly skilled and dedicated professionals with decades of experience in the fields of software development, IT infrastructure, cryptography, and financial services. Our existing validator nodes have secured value on several POS networks since their inception such as Terra, Iris, Solana, Cosmos, Near, E-money, IOV, Solana, Skale, Secret Network, Oasis and others who will soon launch like Celestia or Nomic chain, and Near Protocol.

Our community has an active voice in how we participate in the decentralized ecosystem, and our combined strength will propel the project towards a successful future. We vote on most of the governance proposals, and consult with our delegators before this, it’s important to note that we always vote on what is best for the network.