In the fast-paced world of decentralized finance (DeFi), innovations are constantly emerging to reshape the way we interact with financial products. One such groundbreaking development is Nolus DeFi Lease, a unique leasing platform that challenges the traditional leasing model with its cutting-edge features. Offering financing up to 150% on the initial investment and significantly lower liquidation rates, Nolus DeFi Lease is revolutionizing the way individuals access and manage assets. In this blog, we will explore the key differences between Nolus and traditional leasing, highlighting the advantages of this DeFi solution and why it has the potential to change the financial landscape.

Empowering Users with Customized Parameters

Traditional leasing often involves rigid contracts and standardized terms that may not be tailored to the individual’s needs. On the contrary, Nolus DeFi Lease empowers users by allowing them to choose personalized parameters for the contract. This level of customization ensures that users can create contracts that align perfectly with their financial goals and risk tolerance. Whether it’s the duration of the lease, the collateralization ratio, or other specific terms, Nolus offers unparalleled flexibility to its users, enhancing their leasing experience.

Reducing Collateralization and Unlocking Capital

One of the significant advantages of Nolus DeFi Lease is its unique approach to collateralization. By providing financing up to 150% of the initial investment, Nolus reduces the level of collateralization required by a factor of 3 compared to traditional leasing models. This means that users can secure higher loan amounts while locking up less of their valuable assets as collateral. As a result, Nolus users can unlock additional capital and put it to work for other investment opportunities, boosting their overall financial potential.

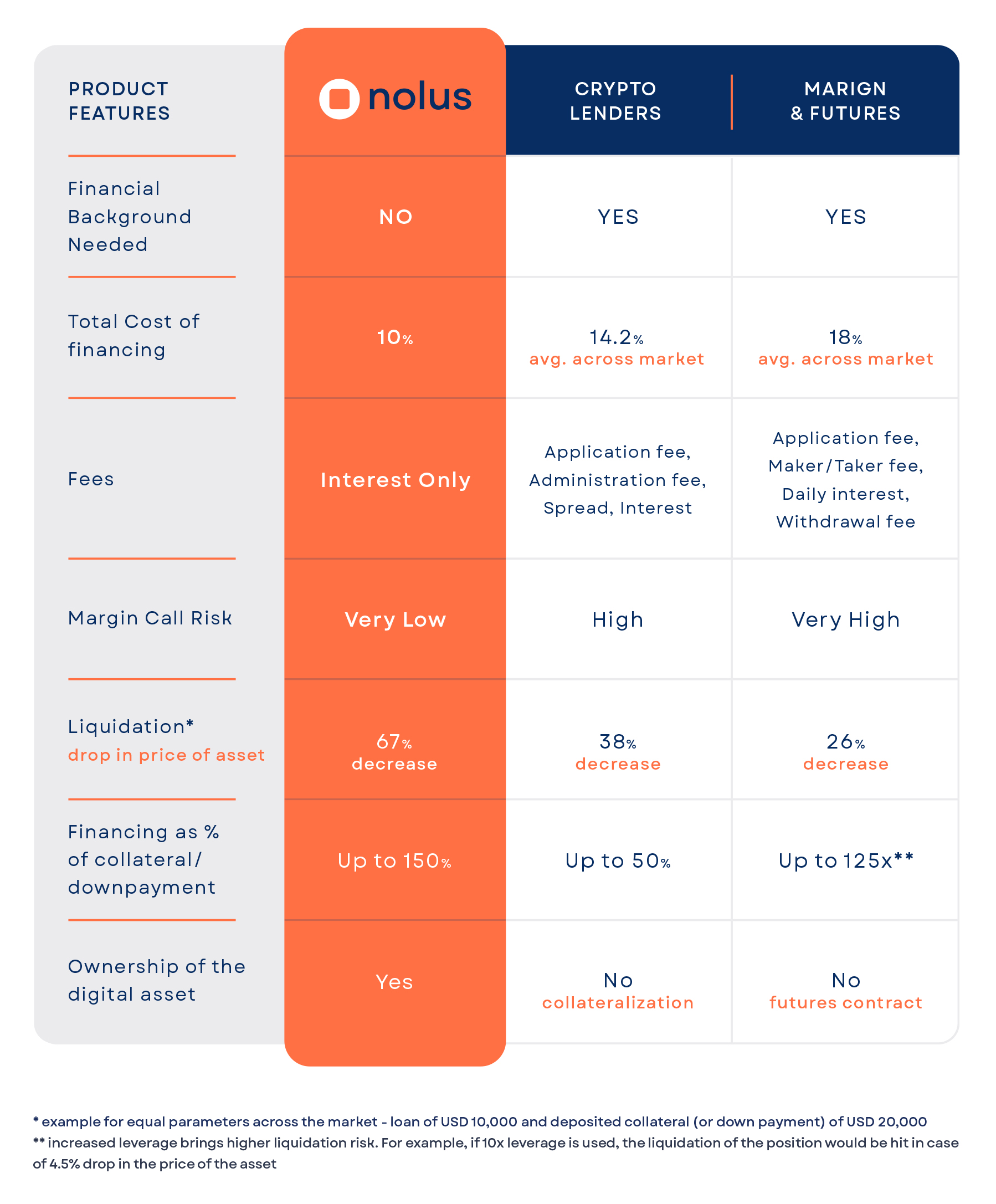

Lower Liquidation Rates: Mitigating Risks

Liquidation is a dreaded scenario in the DeFi world, where assets are seized due to insufficient collateral or unfavorable market conditions. However, Nolus DeFi Lease boasts a remarkable 40% lower liquidation rate compared to the market average when all parameters are equal. This significant reduction in liquidation risk provides users with greater peace of mind and security throughout the leasing period. By employing robust risk management strategies and utilizing sophisticated smart contracts, Nolus ensures a safer and more reliable leasing experience for its users.

Seamless and User-Friendly Process

With Nolus, the user enjoys a quick and clear experience wrapped in an intuitive and easy-to-use UI, with simplified onboardings and processes. The platform’s user interface is designed to make accessing and managing assets as straightforward as possible, even for those new to DeFi. Nolus streamlines the leasing process, eliminating unnecessary complexities, and providing a hassle-free experience from start to finish.

Low Total Costs of Financing and Transactions

With Nolus, total costs of financing and transactions are low – the never-changing interest rate is locked at contract creation, with little to no additional cost for transactions. This transparent fee structure ensures that users can accurately forecast and plan their financial obligations, without any unexpected hidden fees. By eliminating unnecessary expenses and maintaining a predictable interest rate, Nolus maximizes the value of each leasing contract for its users.

Ownership Lies Within the User

With Nolus, ownership lies within the user. Throughout the leasing period, users retain full control and ownership of their digital assets, even as they benefit from the financing provided by the platform. This unique feature allows users to continue participating in the asset’s market movements and potential appreciation while leveraging their assets to pursue other financial opportunities.

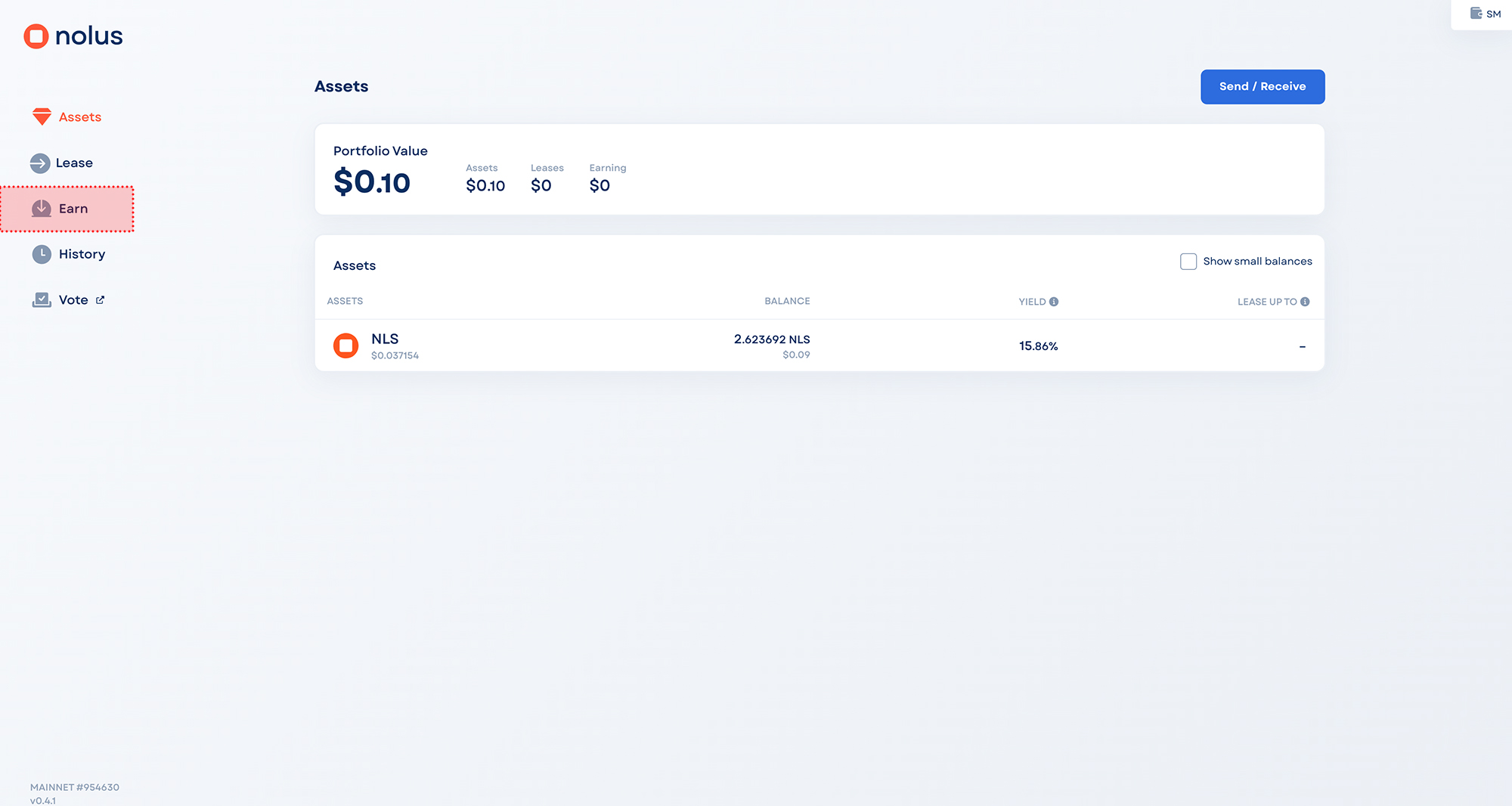

Staking Guide: Maximizing Returns with Nolus via Staking

In addition to its innovative leasing features, Nolus also offers users the opportunity to stake their digital assets for even greater returns. Staking is a process where users lock up their assets within the Nolus ecosystem to support the network’s operations and, in return, earn rewards. Here’s a step-by-step guide on how to stake your assets with Nolus:

Step 1: Ensure sufficient assets in a wallet that supports $NLS (Keplr, Ledger, Leap)

Step 2: Access the Staking Portal: https://app.nolus.io/

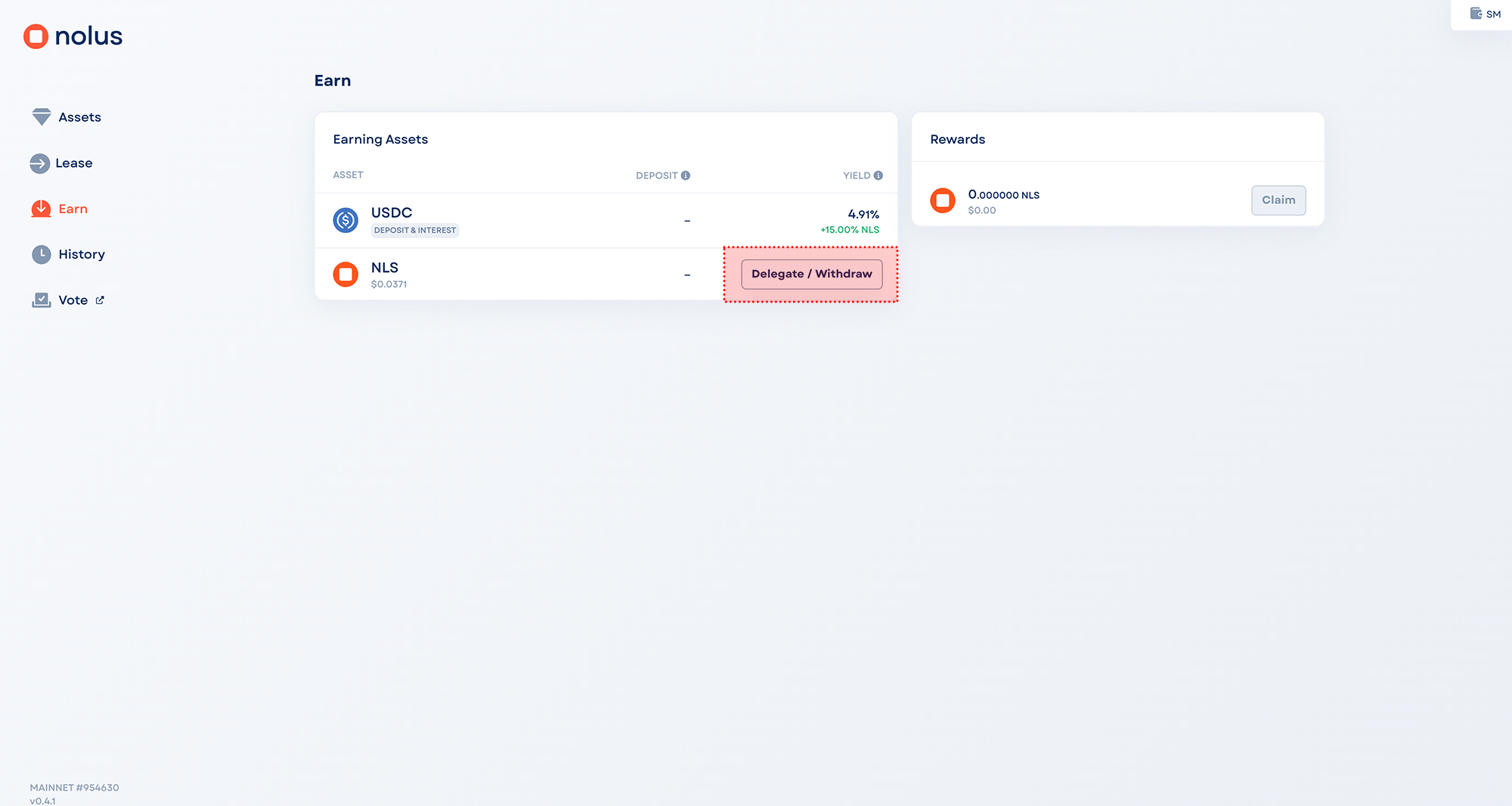

Step 3: Navigate to ‘Earn’ and click on $NLS

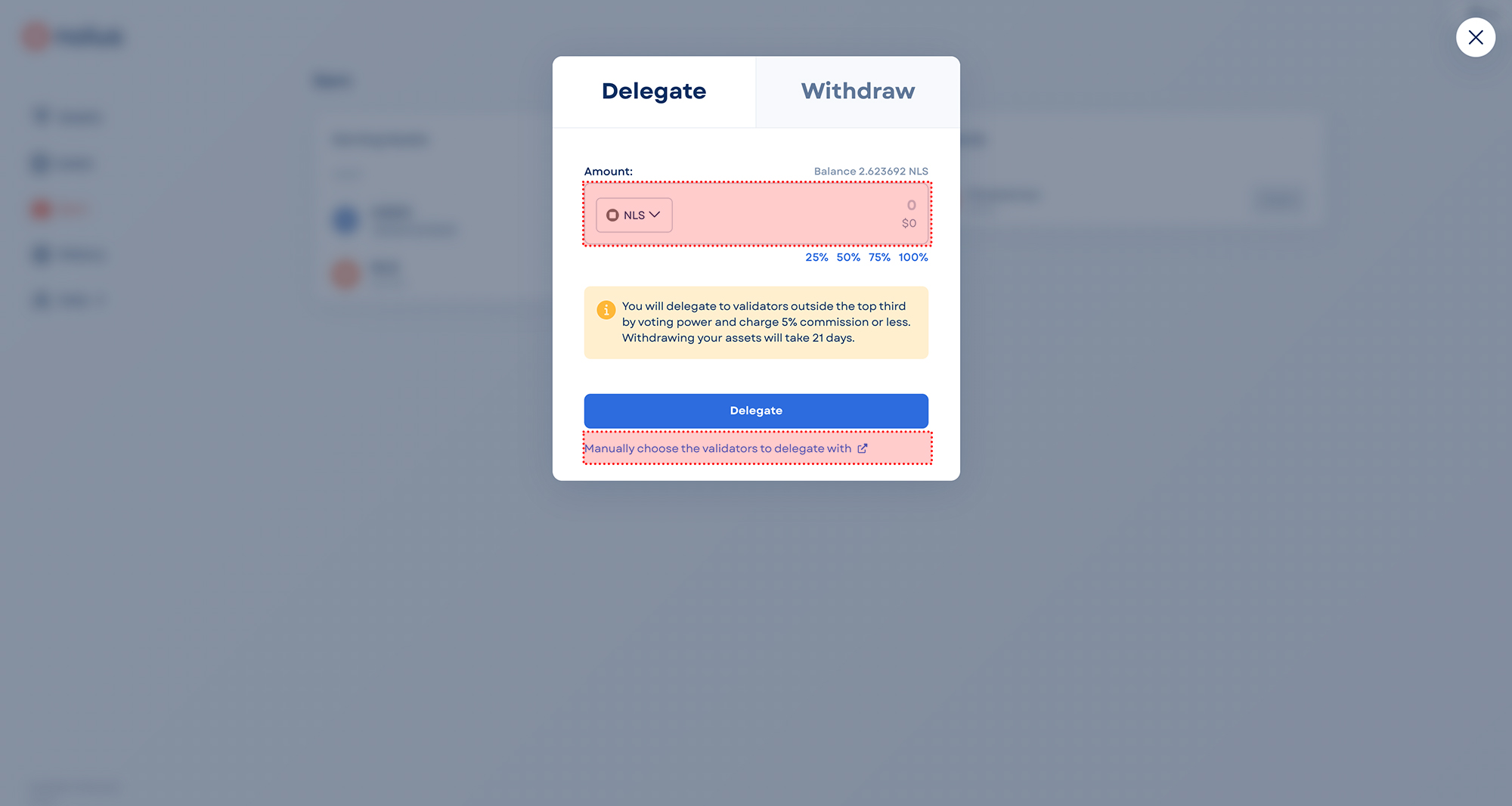

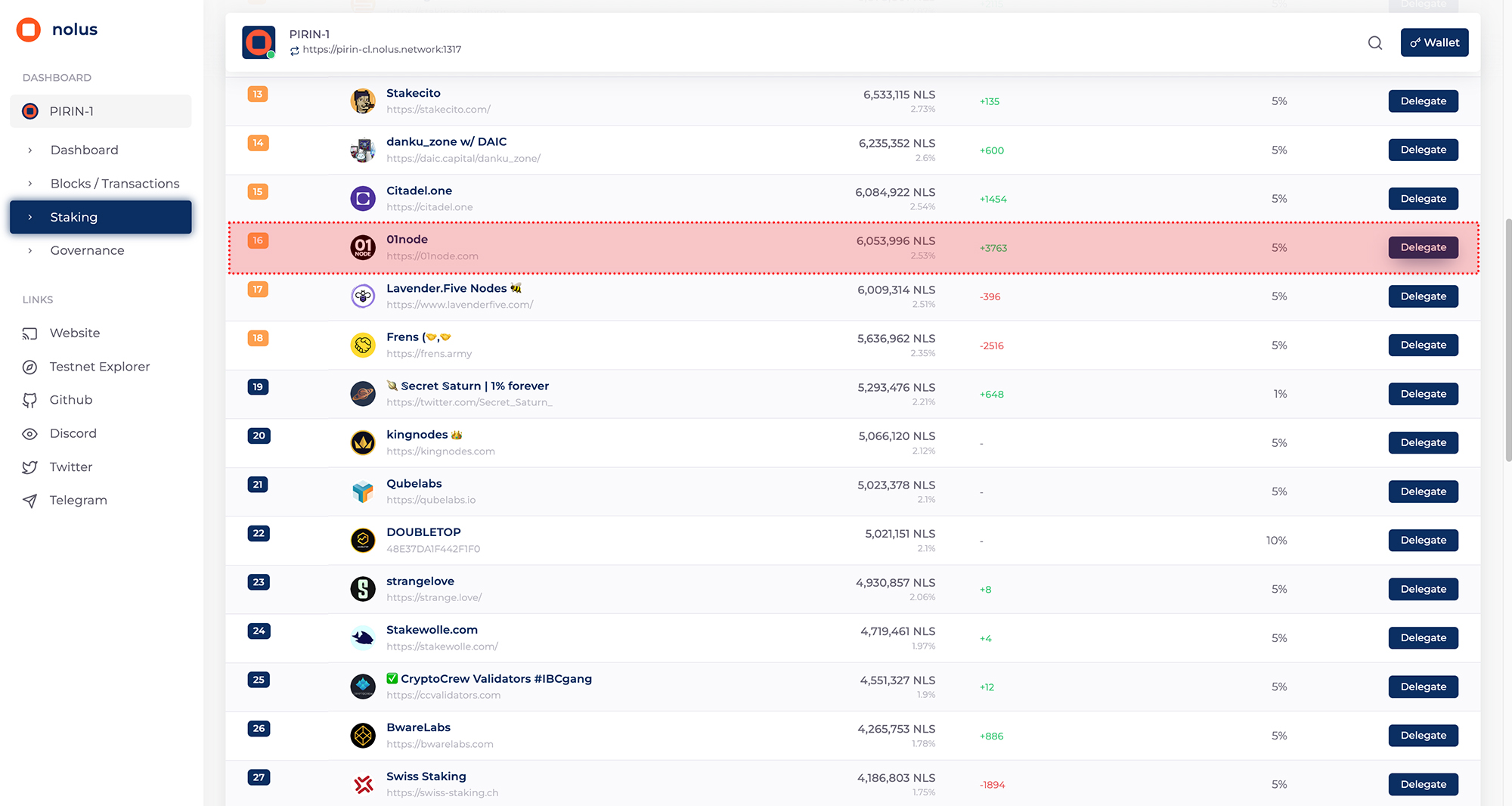

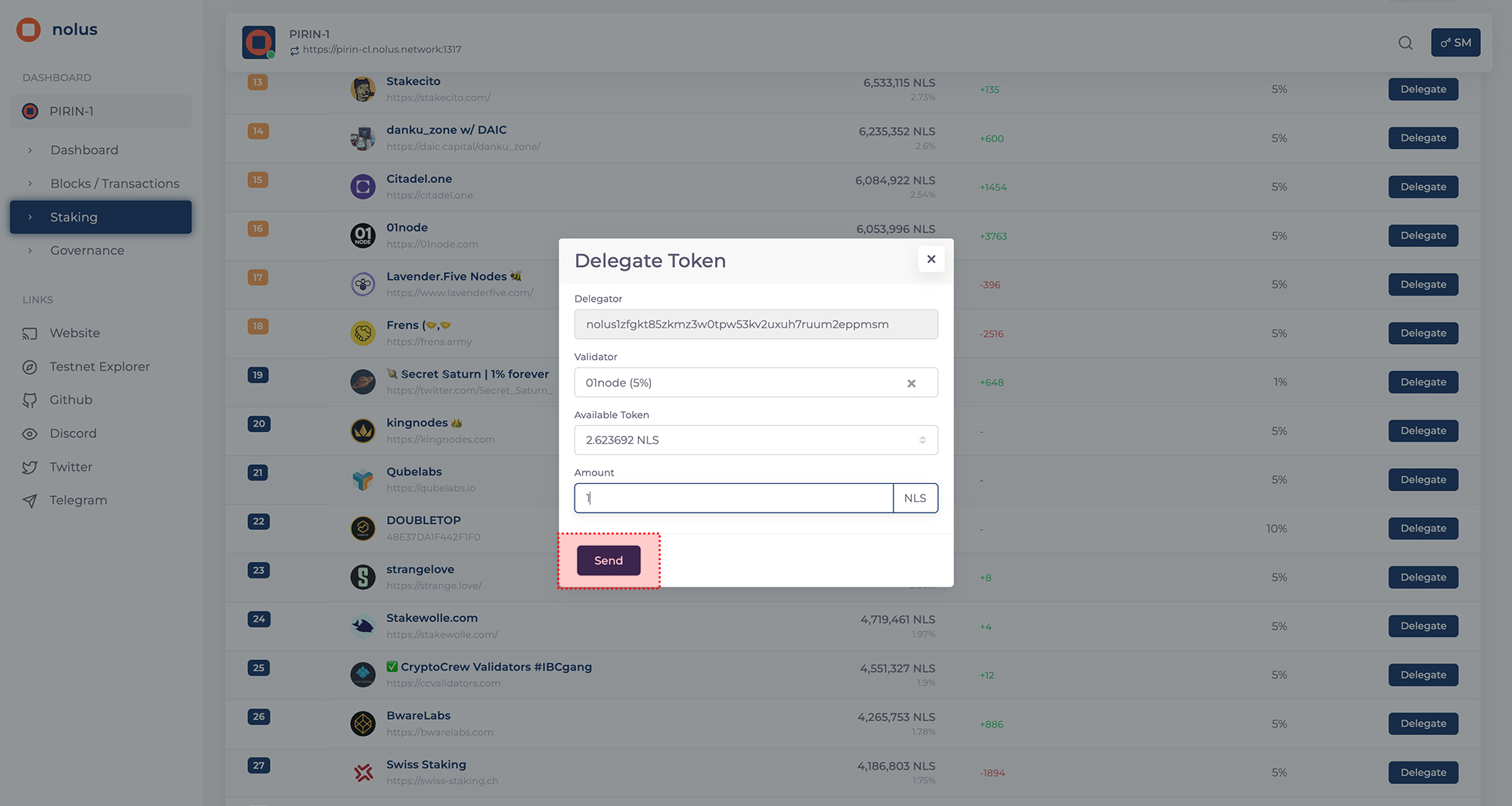

Step 4: Input the Staking amount, and process to delegate to your staking Validator [e.g 01node]

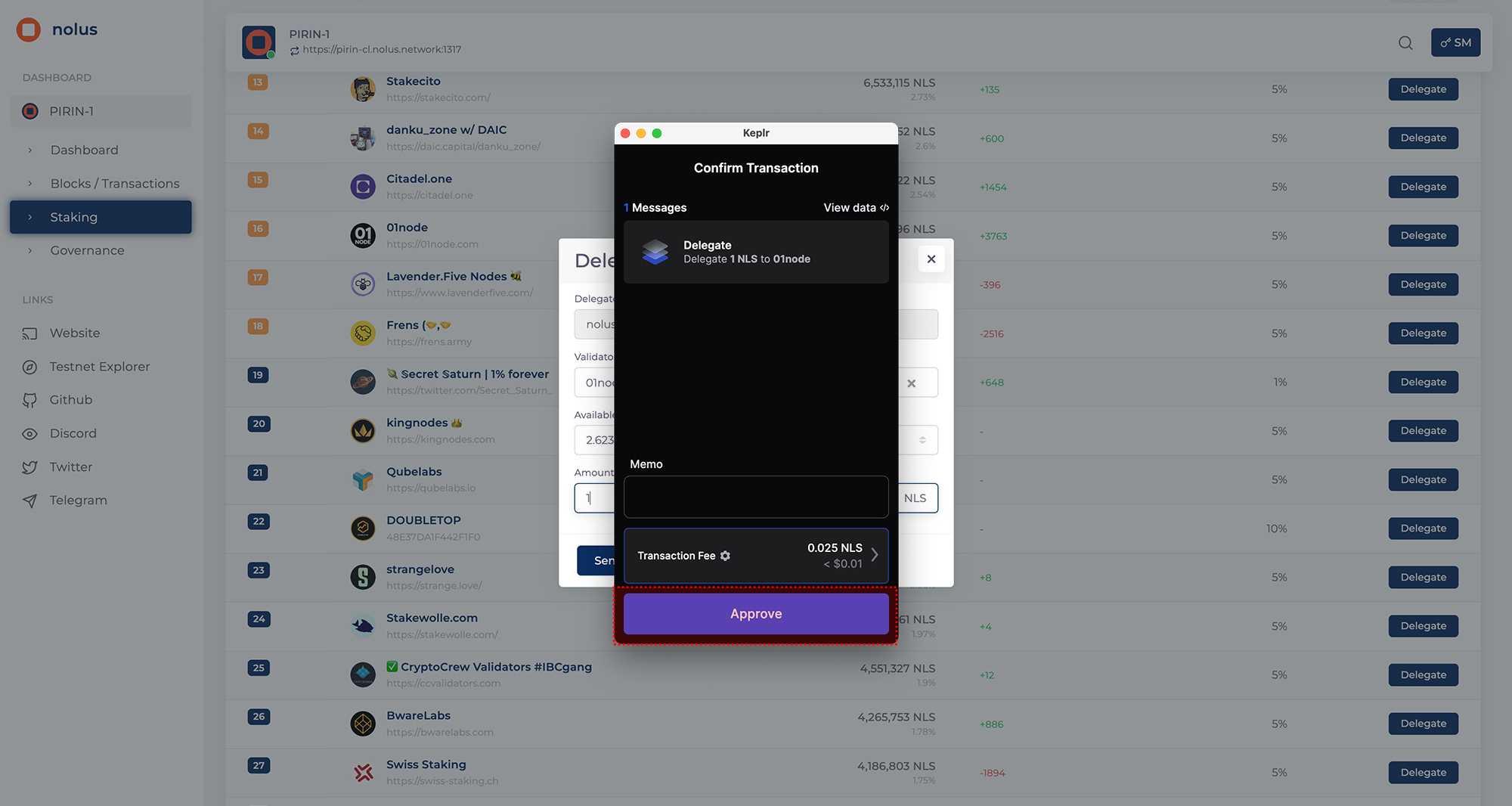

Step 5: Confirm transaction

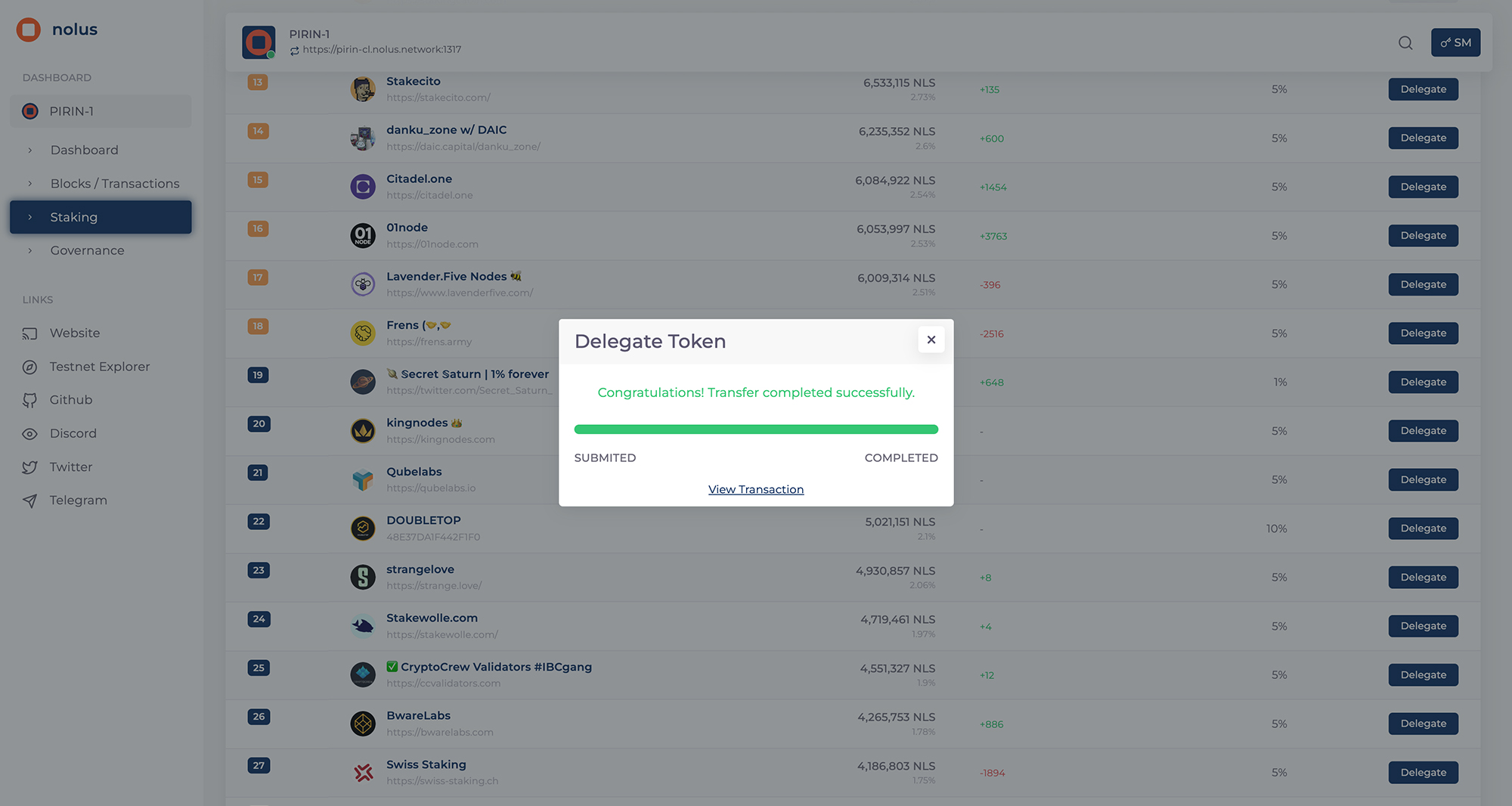

Congratulations, you have successfuly staked your $NLS. Happy staking!

Conclusion

In conclusion, Nolus DeFi Lease represents a paradigm shift in the world of leasing and decentralized finance. By offering personalized parameters, reducing collateralization requirements, and maintaining lower liquidation rates, Nolus empowers users to unlock the true potential of their assets. The three-step process, user-friendly interface, and low total costs of financing and transactions make Nolus an attractive choice for individuals seeking an efficient, secure, and cost-effective leasing platform. As the DeFi space continues to evolve, Nolus stands at the forefront of innovation, challenging the status quo and paving the way for a new era of leasing possibilities.