01node is excited to announce our active involvement as validators on the dydx mainnet. After participating in the dydx testnet and being strong supporters of the chain’s concept, we are now dedicated to the post-genesis mission of achieving maximum security for the network. We eagerly anticipate contributing to the chain’s security and success.

What is dYdX 4?

dYdX represents a decentralized derivatives exchange dedicated to digital assets. It empowers users to engage in permissionless trading of perpetual futures for 36 different digital assets. Low fees and access to leverage characterize this trading.

dYdX v4 is a standalone open-source blockchain software based on the Cosmos SDK and Tendermint Proof-of-stake consensus protocol (“dYdX Chain”). dYdX v4 features a fully decentralized, off-chain, orderbook and matching engine capable of scaling to orders of magnitude more throughput than any blockchain can support.

What to expect with the dYdX chain

The goal is to have open-source code that can power a first-class product and trading experience.

There are a few major technical components of this:

- Core node

The core node is the core software that validators and node providers will run. This is built on top of the Cosmos SDK – the standard framework for building Tendermint blockchains. The core node runs: consensus, off -chain orderbook & matching, all transaction types (deposit, transfer, withdraw, etc), price oracles, and other core systems.

- Indexer

The indexer is an open-source software that powers the APIs and WebSockets, which would serve web, mobile, and programmatic traders. The indexer would take the data that exists on the core blockchain and store it in a much more efficient format, allowing dYdX v4 to serve performant REST & WebSocket APIs. The indexer software could also be run by a distributed network, ensuring that the data will always be available to traders.

- Clients

TypeScript and potentially other language clients to simplify interacting with the network. Clients connect to both indexers and core nodes, and could be used by programmatic traders as well as the website.

The dYdX Bridge

The dYdX chain underwent three distinct phases before its launch: the Pre-Genesis, Genesis, and Post-Genesis. The Post-Genesis phase is particularly crucial for the chain as it is where the Alpha network attains security through staking.

A key factor in achieving this stability is the amount of DYDX tokens staked with the Validators of the dYdX Chain. It is anticipated that a significant commitment of DYDX tokens must be staked with dYdX Chain validators to establish a robust security infrastructure before moving to the Beta stage (pending governance). DYDX token holders should consider prioritizing the staking of their DYDX tokens with Validators. This collective staking approach is essential for strengthening the network’s resilience and ensuring a smooth transition from the Alpha to Beta phase.

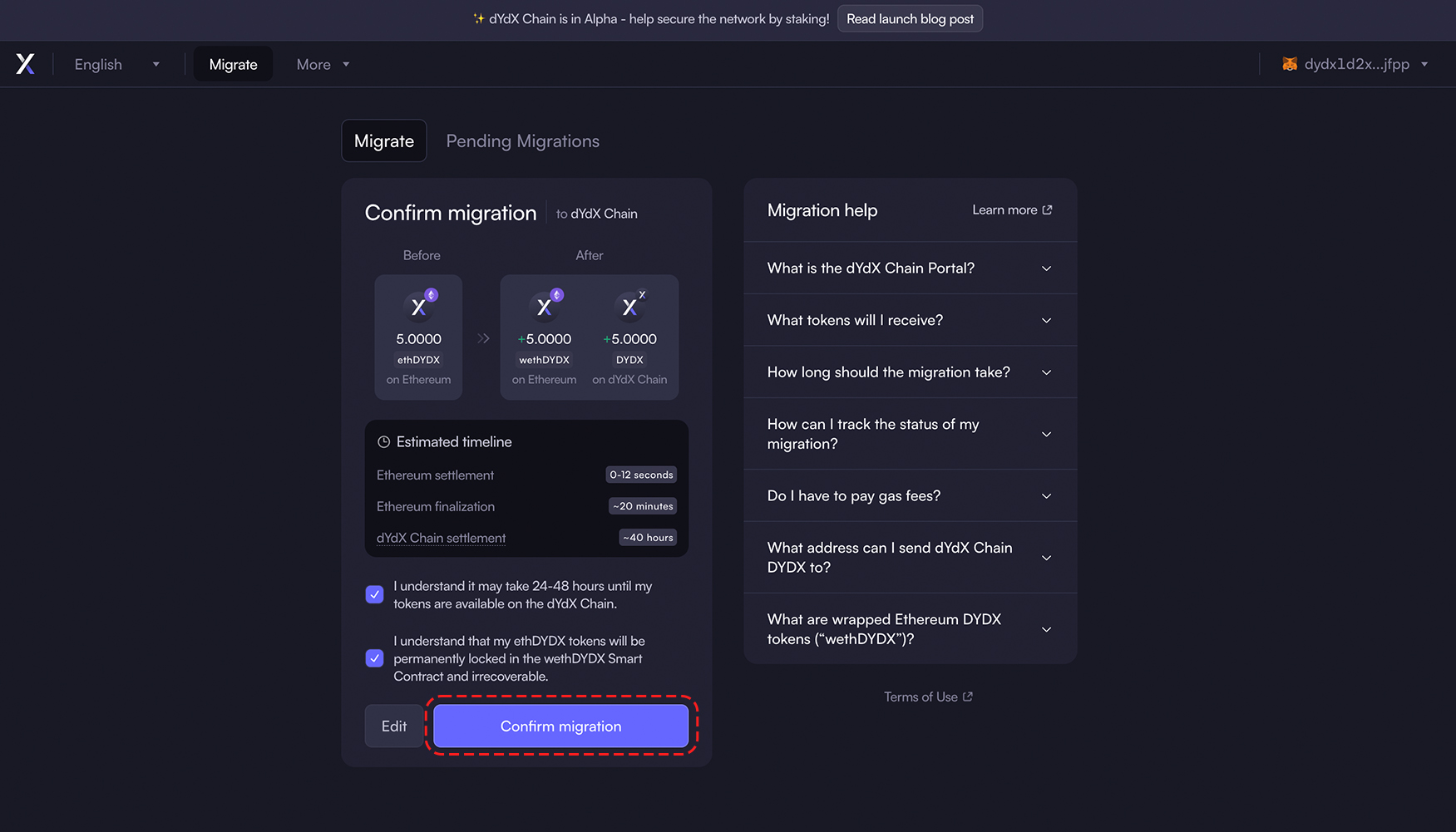

Furthermore, since the dYdX chain migrated from Ethereum Layer 1 to its standalone app-chain, they have introduced a bridge portal for token holders on the Ethereum chain to transition from ethDYDX to DYDX on the dYdX Chain. The bridging process is pivotal at this stage and is designed to facilitate a seamless transfer of assets from ethDYDX to DYDX on the dYdX Chain. Notably, the public bridge frontend is accessible at bridge.dydx.trade.

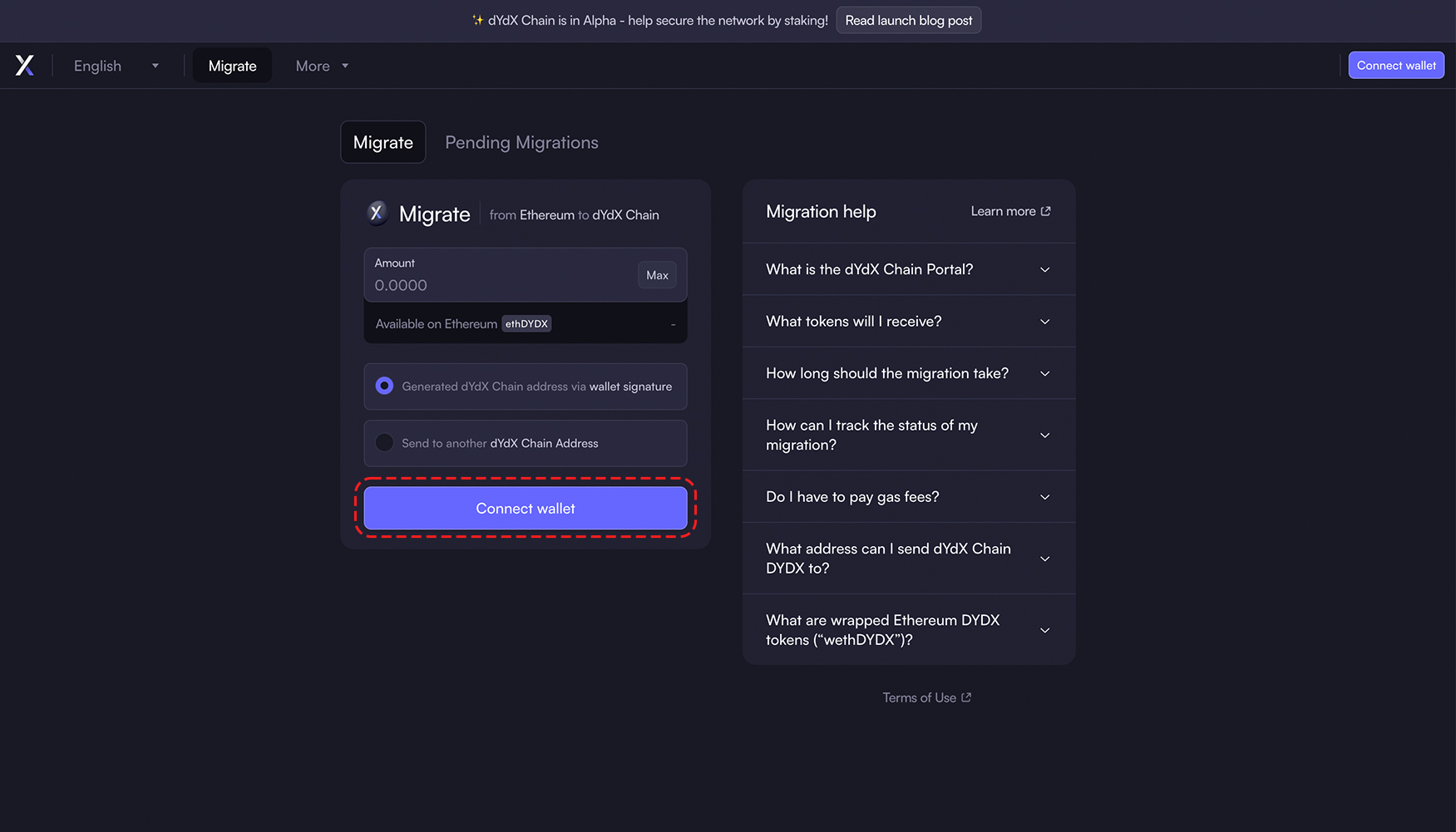

- Step 0 – Visit bridge.dydx.trade to initiate the migration process

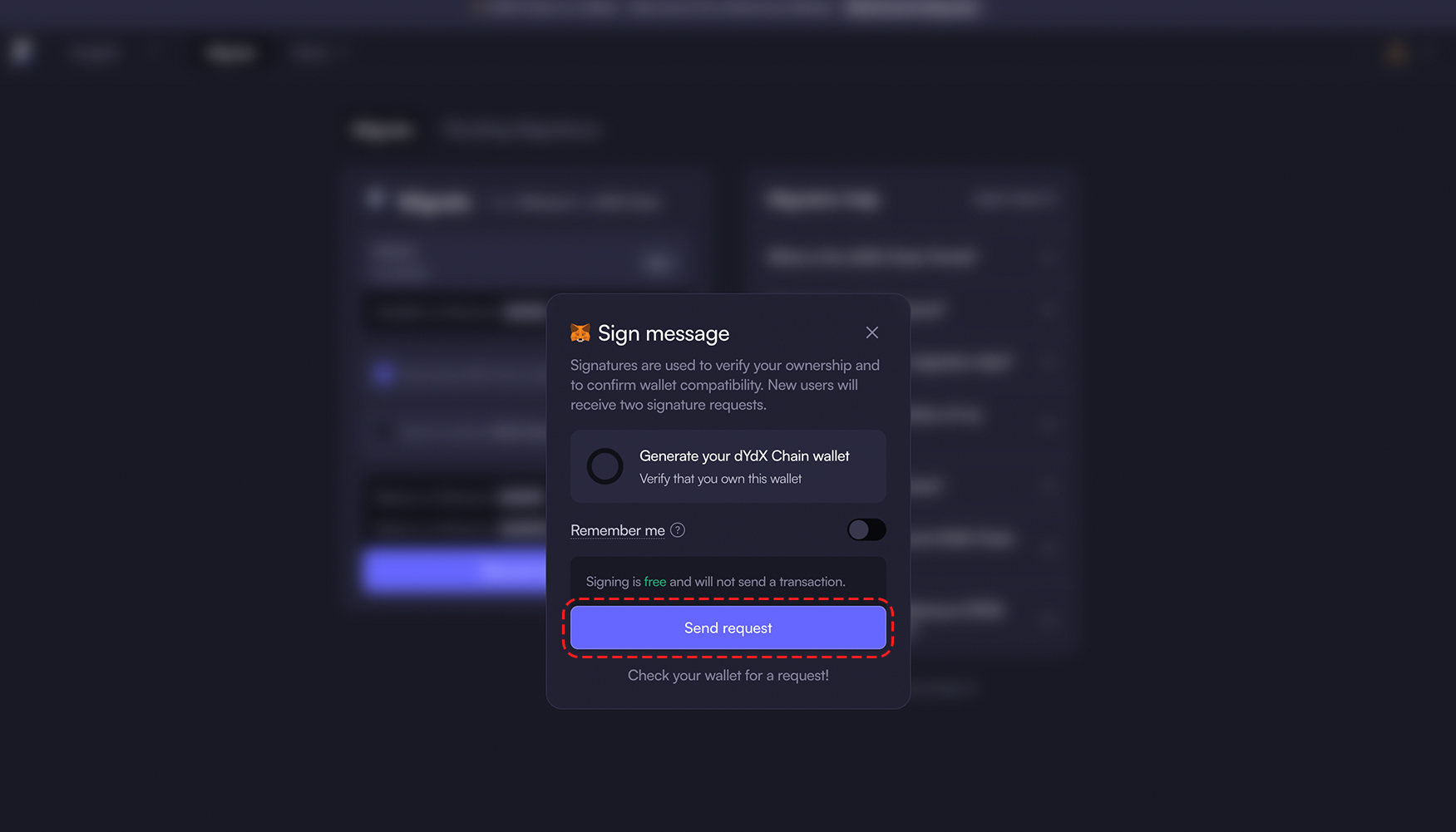

- Step 1 – Connect a wallet holding ethDYDX to generate dYdX Chain address

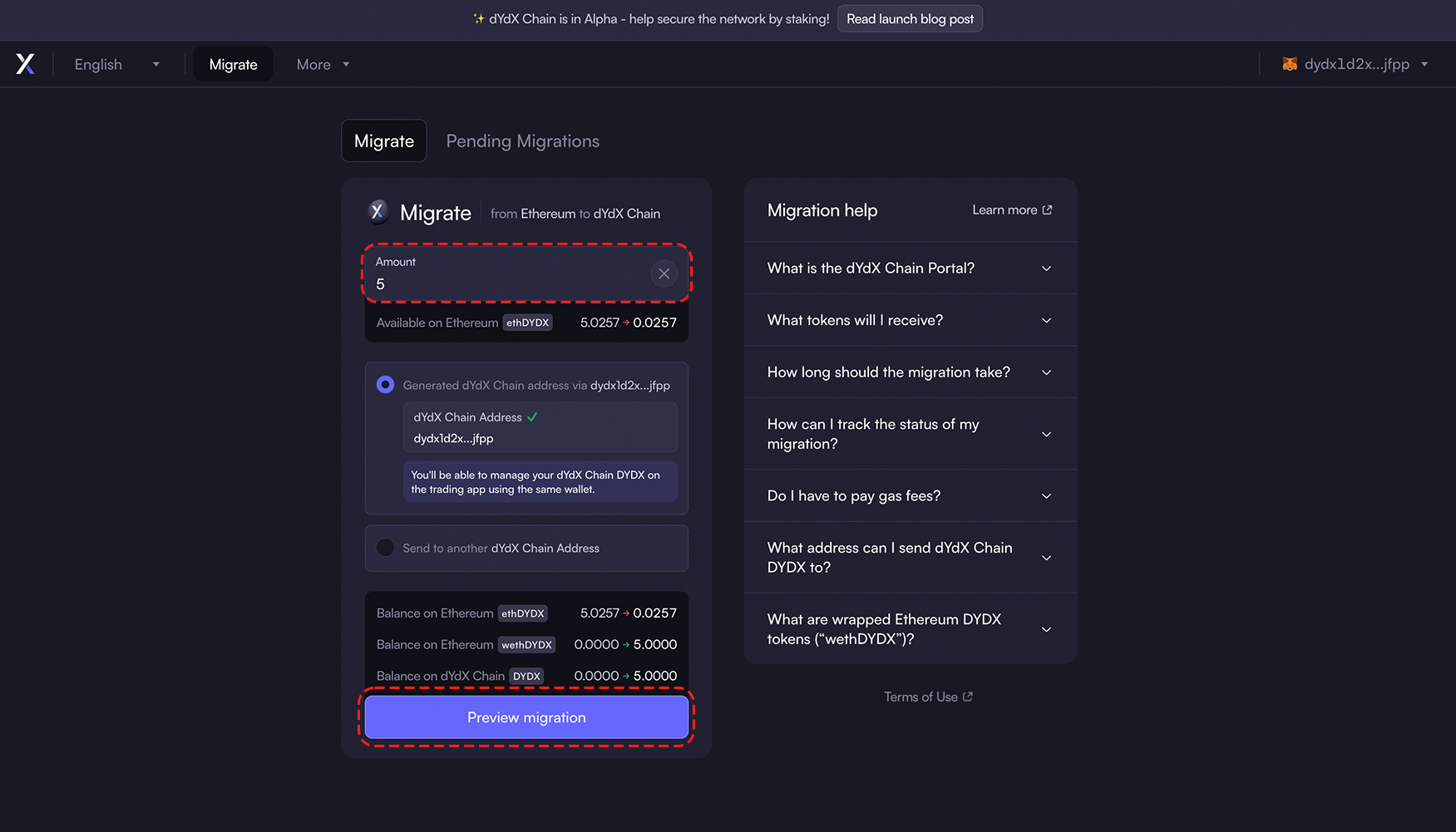

- Step 2 – Enter the amount of ethDYDX token to migrate

- Step 3 – Choose a recipient address to migration to on dYdX Chain

- Step 4 – Preview migration details

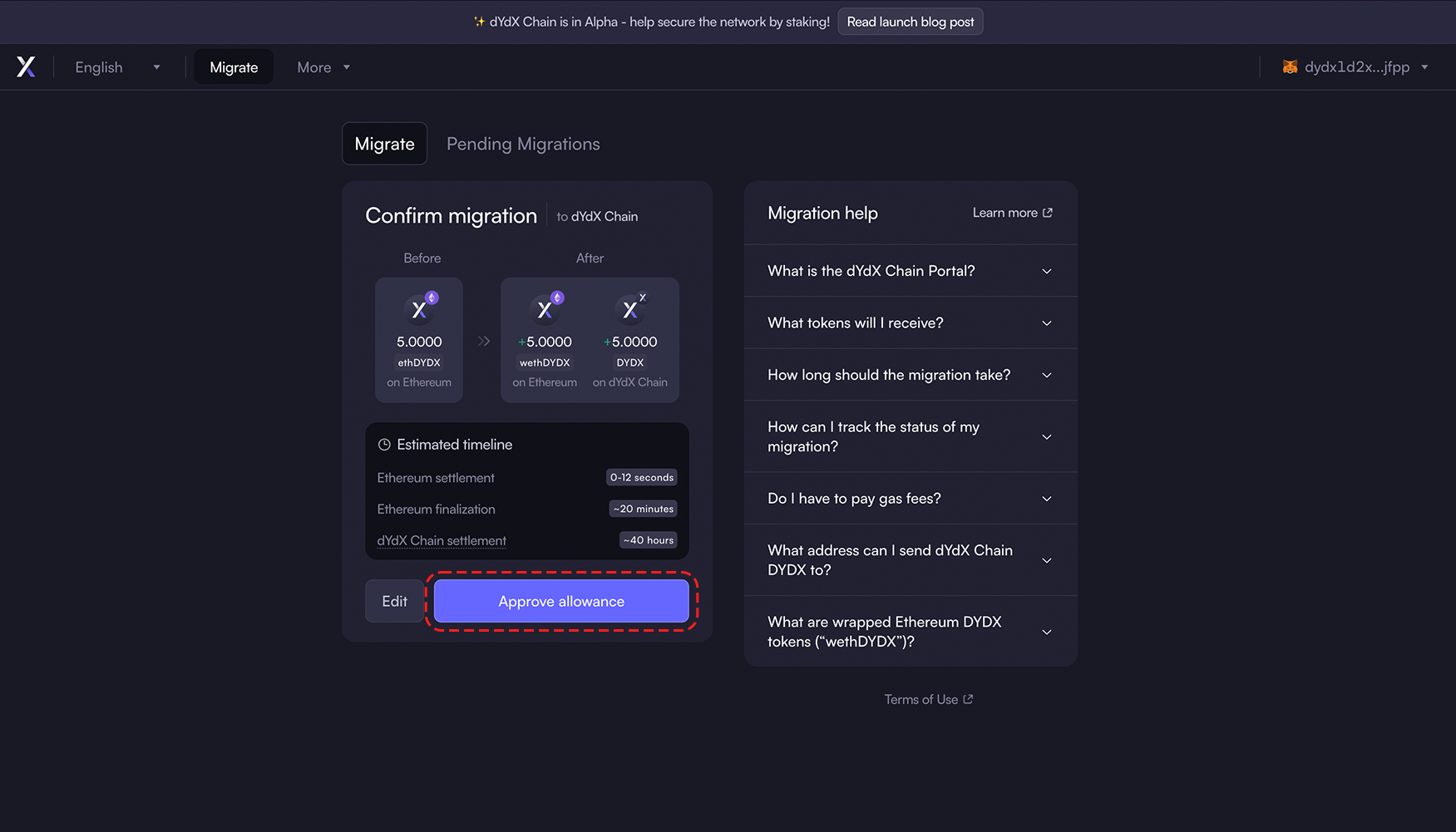

- Step 5 – Authorize the wethDYDX Smart Contract

- Step 6 – Confirm migration by signing with wallet

- Step 7 – Check status of your migration

How to stake $dYdX [A Step-by-Step Staking Guide]

Step 1: Log into Keplr and connect your account.

Step 2: Search for the dYdX Chain and locate the 01node Validator.

💡 Validator’s address: dydxvaloper1c4u24hycep9mzp6498ra9j2lm58v2y047s3za9.

Step 3: Click on the 01node validator and input the amount you wish to stake.

Step 4: Click ‘Stake’ and follow the staking process.

Step 5: Approve the transaction. Congratulations, you have successfully staked DYDX with 01node!

Key details regarding dYdX staking include:

- Unbonding Period: A 30-day duration, as outlined in their rewards and parameters.

- Slashing Penalties: Downtime and double-signing incidents are both eligible for slashing. Validators who double-sign face removal from the validator set and a prohibition from rejoining.

dYdX Tokenomics

The dYdX token was introduced on Ethereum in September 2021. As the dYdX app-chain comes into play, users will have the opportunity to transfer their tokens from Ethereum to the new Standalone chain.

A total of 1,000,000,000 ethDYDX have been minted, and started to become accessible over five (5) years, on August 3rd, 2021, at 15:00:00 UTC. The initial five-year allocation of the total supply of $ethDYDX was as shown below: To learn more LINK

Governance

The beauty of dYdX lies in its decentralized governance model. All token holders can propose and vote on protocol adjustments, with each token translating to a single vote. The dYdX team is actively committed to advancing decentralization.

In addition to token holder votes, the dYdX community has formed various committees to oversee the protocol and its roadmap:

- Token Holders: These individuals can propose changes to a wide range of protocol parameters, including adding or removing markets, determining the distribution of future tokens, adjusting fee schedules, and voting on the usage of the insurance fund.

- dYdX Foundation: As a nonprofit organization, it plays a pivotal role in nurturing and supporting the dYdX protocol ecosystem by fostering communities, developers, and decentralized governance.

- dYdX Sub DAOs: These include the Grants Program, which enables initiatives and offers grants for their completion, and the Operations subDAO/Trust (DOT), which ensures the seamless operation of critical community infrastructure, such as one frontend, one indexer, and one iOS app, as proposed in DIP 23.

Safely Storing Your dYdX

When it comes to the security of your digital assets, it is highly recommended to utilize a hardware staking wallet, typically a USB ledger, or a software wallet, which can be in the form of a browser extension or a mobile app. Crypto wallets are responsible for safeguarding your private keys, which act as the access credentials for your cryptocurrencies.

Caution: Not all wallets offer staking features, so conduct thorough research before making a selection.

Several wallets compatible with DYDX are available, facilitating staking and earning rewards. Some of these wallets include Metamask and Trust Wallet.