In the evolving cosmos of Proof-of-Stake and interchain networks, a major friction point remains: tokens get staked, locked for long periods, and while they earn rewards they cannot be used elsewhere. Drop Protocol aims to solve this by offering liquid staking services for interchain assets, thereby unlocking value that would otherwise remain tied up.

Important Update

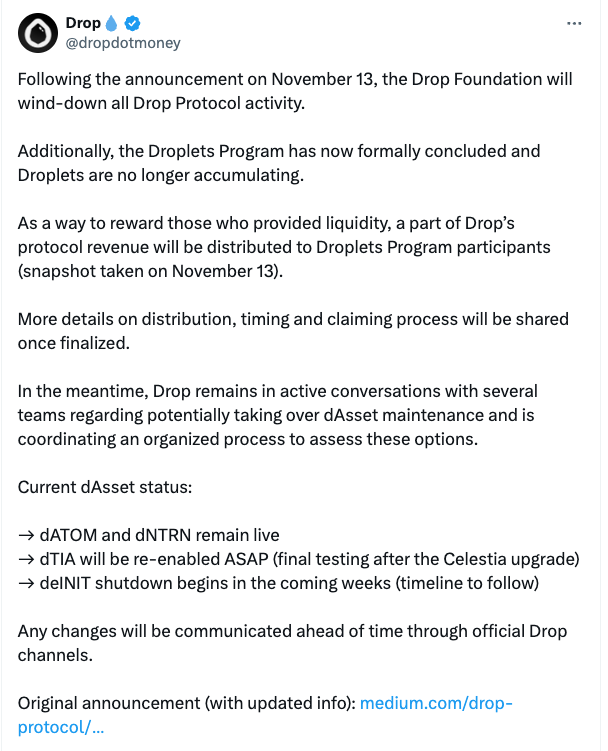

On November 13, the Drop Foundation announced that it will wind down all Drop Protocol activity. The Droplets Program has officially concluded, no new droplets are accumulating, and a portion of protocol revenue will be distributed to program participants (snapshot from November 13).

The current status of dAssets is as follows:

- dATOM and dNTRN remain live,

- dTIA will be re-enabled after final testing following the Celestia upgrade,

- dINIT will begin shutting down in the coming weeks.

Drop is in ongoing discussions with several teams regarding potential continuation of dAsset maintenance. All future updates will be shared through official Drop channels.

What is Drop Protocol?

Drop Protocol is a liquid staking protocol built on the Neutron chain, designed specifically for “interchain” assets. That is, tokens from sovereign chains in the Cosmos / IBC ecosystem. Its mission is: to strengthen the economic viability of sovereign blockchain economies by transforming stagnant, frozen capital into flowing streams of opportunity.

Rather than simply staking assets and waiting for rewards, Drop allows users to deposit supported tokens, receive dAssets (liquid representations of the staked assets) and then deploy those dAssets into other applications or simply hold them, all while still earning staking rewards. In essence, staking becomes more flexible, composable and productive.

Drop is also a member of the Lido Alliance, meaning it aligns itself with ecosystem efforts around liquid staking and decentralised operator frameworks.

How Drop Protocol Works

The architecture of Drop Protocol is rooted in a few key components:

1. Deposit and Minting of dAssets

When a user deposits a supported token — for example, ATOM (the native asset of the Cosmos Hub) — into Drop, the protocol stakes that asset and mints a corresponding liquid derivative (“dAsset”) such as dATOM. This derivative is freely tradable or usable in other decentralised applications, while the underlying stake continues earning rewards.

2. Auto-Compounding & Liquidity

The minted dAssets automatically represent the staked asset’s yield: rewards are compounded, meaning the value accumulates in the derivative token rather than requiring manual reinvestment. Meanwhile, because the derivative token is liquid, users retain optionality. They can exit, trade, or deploy the token elsewhere.

3. Interchain / IBC Infrastructure

Drop is built on Neutron and uses modules like IBC (Inter-Blockchain Communication), ICTX (Interchain Transactions) and ICQ (Interchain Queries) to coordinate across multiple chains. This enables Drop to serve multiple chains, making it truly interchain rather than single-chain in scope.

4. Ecosystem Integration & Usage

The protocol invites developers, validators and other ecosystem participants to integrate with dAssets: for example, dAssets can be used as collateral, in DeFi applications, for liquidity provision, and in any smart contract that accepts them. This composability is part of the value proposition: staking isn’t just locked, it becomes active capital.

What Advantages Does Drop Protocol Provide?

From a user (staker) or ecosystem participant’s point of view, Drop offers multiple advantages:

- Liquidity while staking: Rather than locking assets for long periods and having no flexibility, users receive a tradable derivative (dAsset) which can be used or held.

- Increased capital efficiency: The staked asset earns rewards and the derivative can be deployed in other protocols, generating additional yield.

- Interchain reach: Because Drop is built for interchain assets, users of multiple sovereign chains (not just one) can benefit from its services, which matters in the Cosmos/IBC ecosystem.

- Composability: dAssets can be built into other DeFi/finance smart contracts, making the staking yield part of a broader financial strategy.

- Auto-compounding: The design includes mechanisms for auto-compounding of staking rewards, which simplifies yield management for users.

- Support for multiple stakeholders: Developers and validators are part of the system architecture, meaning Drop is not just a front-end product but also infrastructure-oriented.

Considerations & What to Watch

As with any protocol, especially in a rapidly evolving interchain context, there are factors to watch:

- Supported assets and chains: While the architecture is built for many chains, real-world support depends on which assets and networks Drop enables and how quickly.

- Derivative token risks: Holding a dAsset carries derivative and smart-contract risk (e.g., protocol bugs, platform risk) in addition to staking risk.

- Integration uptake: The value of the liquid derivative depends on ecosystem adoption, how many protocols accept dAssets, and how much capital flows into them.

Why Drop Protocol Matters Right Now

In the broader DeFi and staking landscape, liquidity has become an epicentre of innovation. Many stakers wish they could deploy value rather than lock it. At the same time, multi-chain ecosystems (like those built around IBC) need infrastructure that can operate across chains, not just within one silo. Drop Protocol addresses both trends: it unlocks staking liquidity and operates interchain.

Protocols like Drop signal a shift: staking is no longer just about locking assets and securing a chain. It’s about composability, capital efficiency and cross-chain security. This means validator operations, tooling and infrastructure need to evolve. Drop’s focus on the interchain makes it especially relevant: as more chains interoperate, staking and infrastructure become multi-dimensional.

Conclusion

Drop Protocol is one of the more compelling entrants in the liquid staking space,particularly because it focuses on the interchain rather than a single chain, offers derivatives (dAssets) that maintain liquidity, and emphasises both user flexibility and ecosystem integration. Yes, there remains work ahead (supporting more assets, accelerating integrations, managing risks) but the foundational architecture is strong and the vision coherent.

For stakers, DeFi users or infrastructure operators, Drop is a protocol worth monitoring and, for some, engaging with. If you’re interested, take a look at Drop’s official documentation directly and evaluate how their supported assets, dAssets and integrations align with your staking strategy.