Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it”.

What is compounding interest

Compound interest is the interest earned on the original investment plus any accumulated interest. Not only do you get interest on your initial deposit, but you also get interest on your interest.

For example, if you earn 10% annual interest, a deposit of $1000 would gain you $100 after a year. What happens the following year? That’s where compounding comes in. You’ll earn interest on your initial deposit, and you’ll earn interest on the interest you just earned.

The interest your money earns the second year will be more than the year before, because your account balance is now $1100, not $1000. But to take advantage of these tools, you need to adopt a long-term strategy.

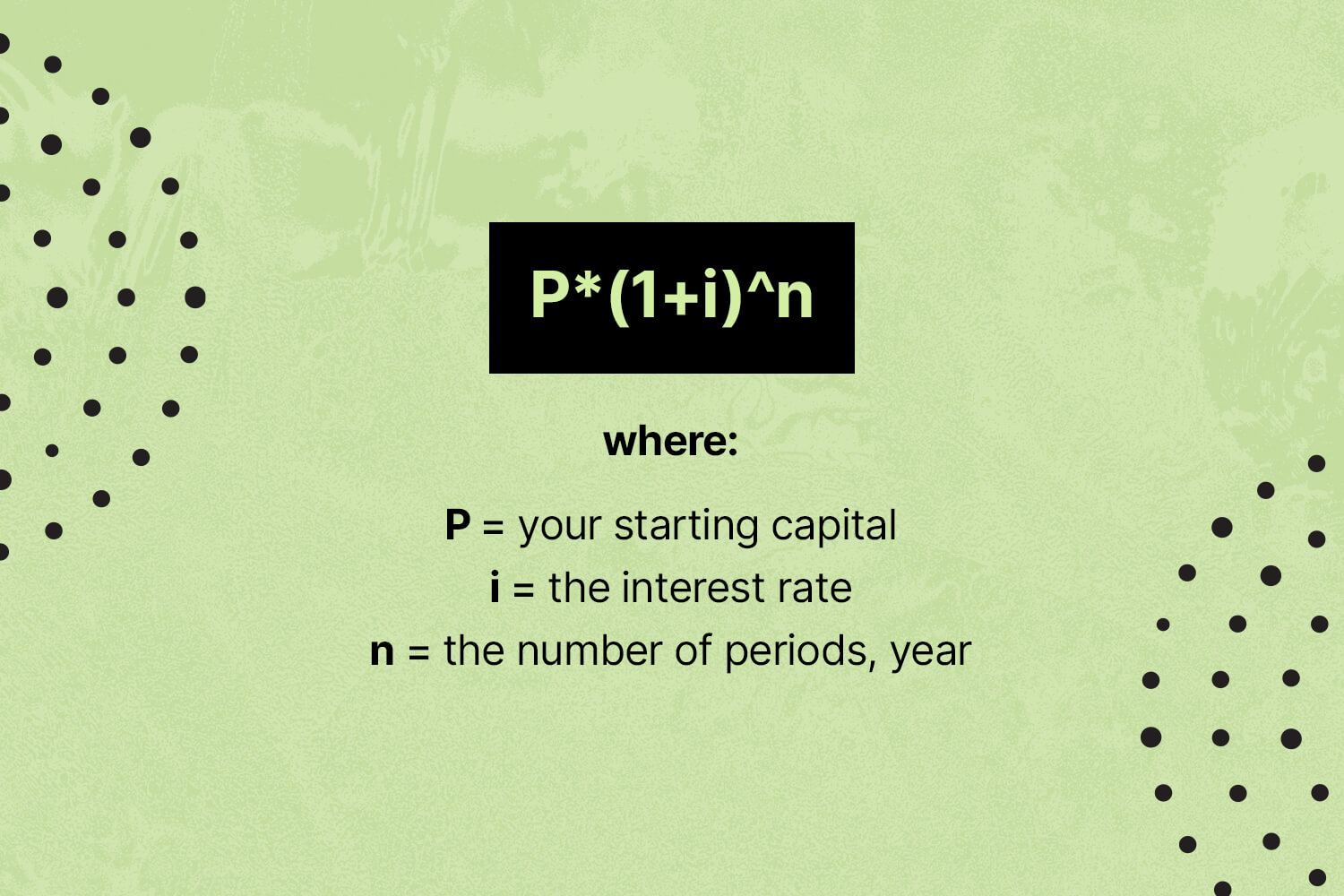

How do I calculate my gain?

By following the compound interest mathematical formulas:

👉 Let’s take a simple example:

$10,000 at a simple interest rate of 10% annual interest for 5 years will give you a total capital of $15,000 while with compound interest, your total capital would then be $16,105.1. Isn’t it amazing how much of a difference there is?

A last example this time for 10 years, this will give you a final capital of $20,000 with simple interest rates while with compound interest, your final capital would be $25,937.4.

Compounding in Crypto

While some savings accounts offer 5% yearly compound interest, you may easily stake and earn compound on certain coins for annual yields of up to 100%.

However, it’s important to remember that cryptocurrency, like any other investment, carries risks. The annual percentage yield (APY) can and does change. More significantly, you can’t ensure that the value of your coins will not depreciate. Even in local currencies, inflation is a factor: a 0.50 % annual percentage yield on a classic high-rate savings account won’t carry you very far if inflation is at 2–3%. (in many regions, inflation rates are even higher).

How to compound your crypto

There are multiple ways to make sure your interest earned doesn’t just gather dust. It can be carried out automatically or manually

- By using the Auto-Subscription feature on Centralized Exchange (CEX) Savings Apps

- Reinvest the capital and interest and rollover

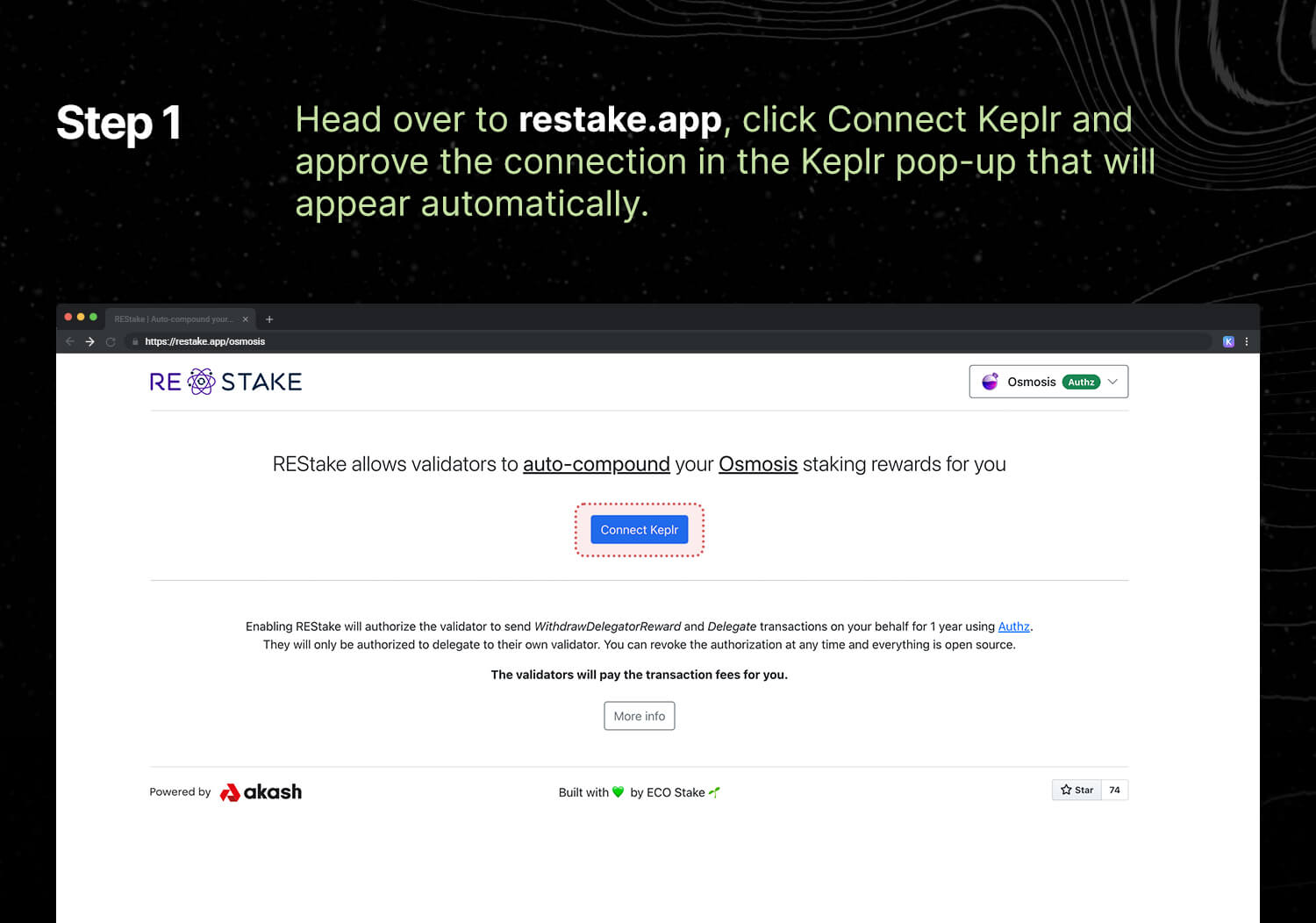

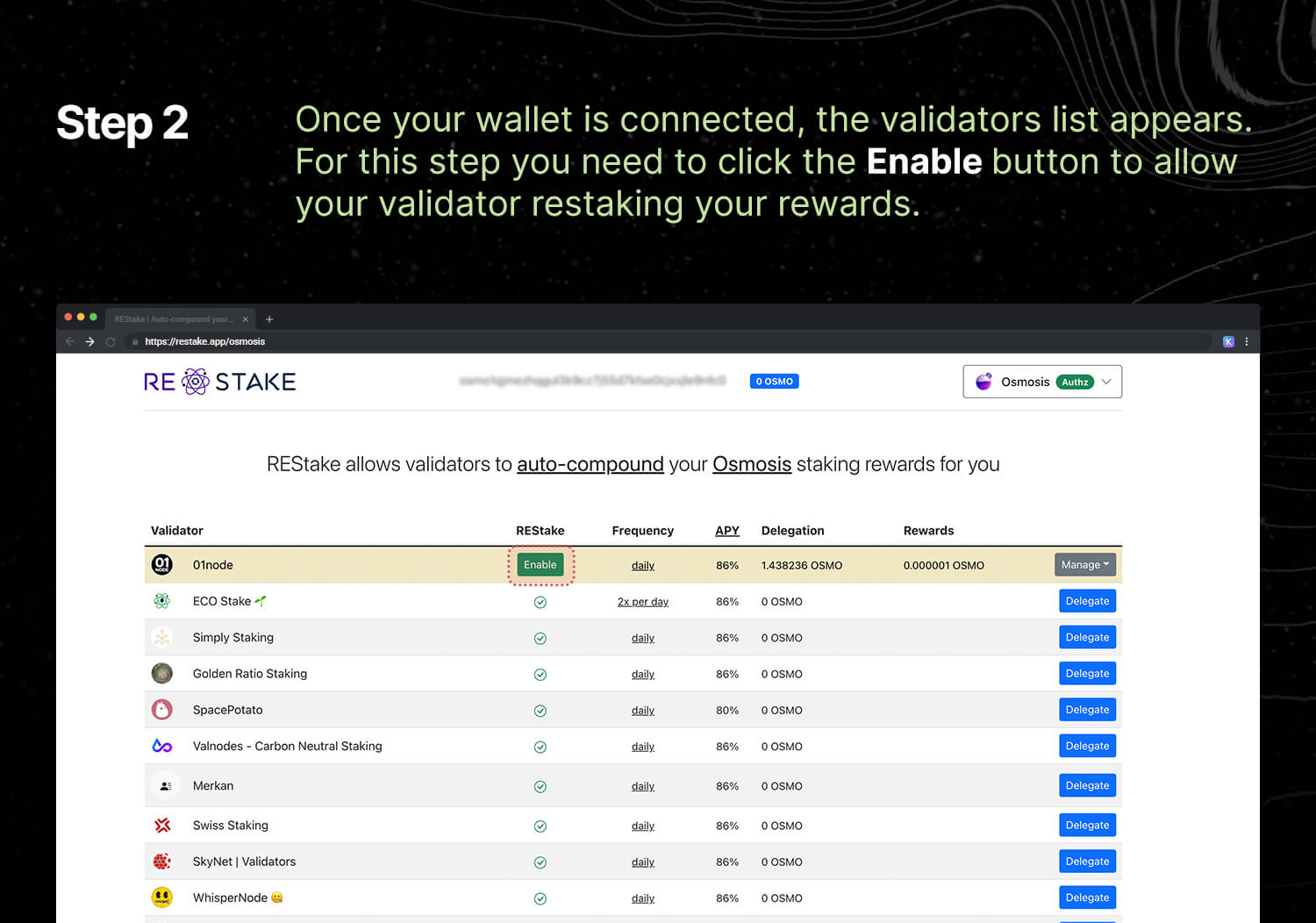

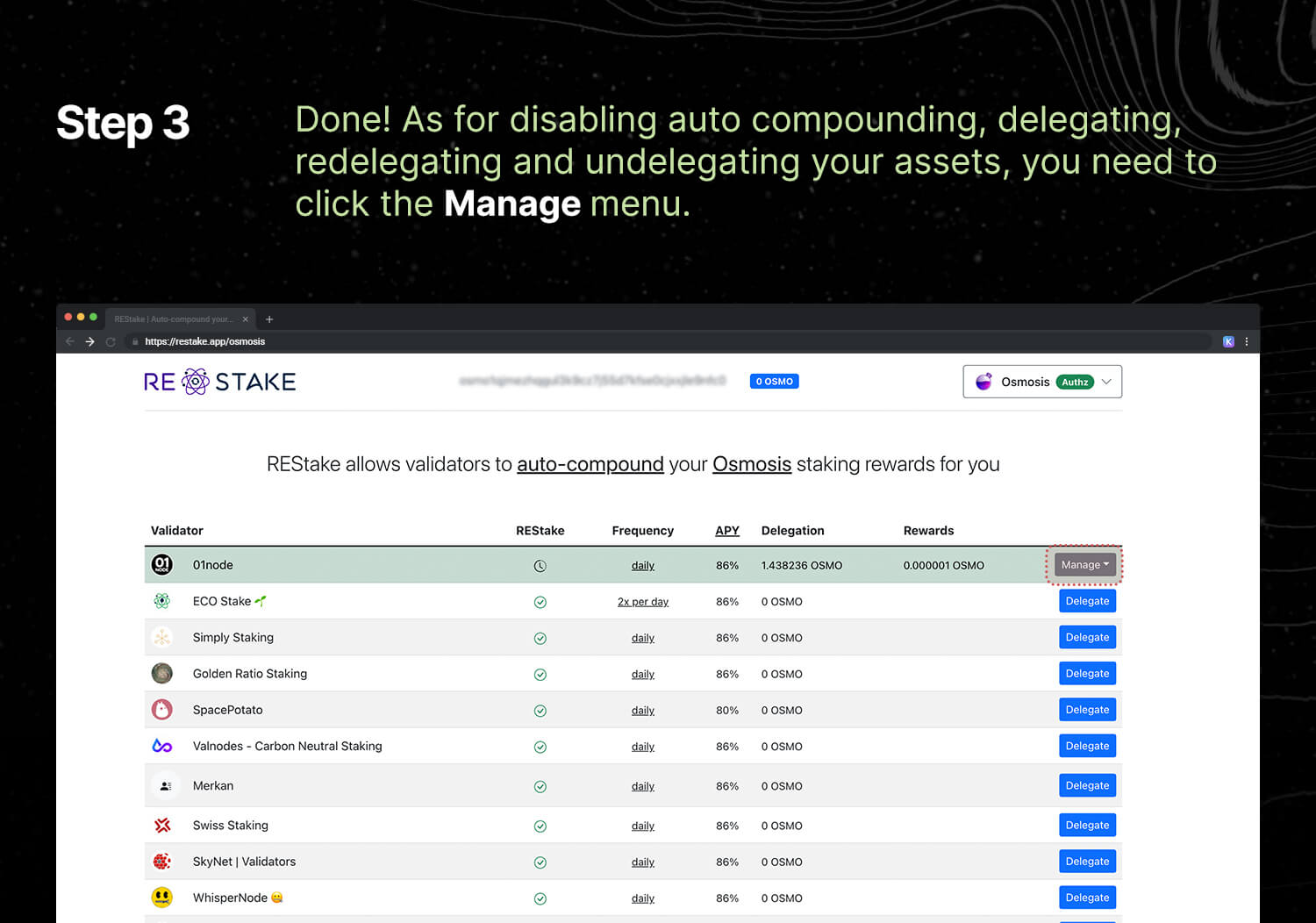

- By using the REStake App. REStake allows validators to auto-compound your Osmosis staking rewards for you.To get started: 👇

Rule of 72

The Rule of 72 is another way to make quick estimates about compound interest. This method can give you a rough estimate of how long it will take to double your money by looking at the interest rate and the length of time you’ll earn that rate. Multiply the number of years by the interest rate. If you get 72, you’ve got a combination of factors that will approximately double your money.

Conclusion

To fully benefit from compounding interest, it is essential that you play the long-term game. Patience is key. The longer you allow your interest to accumulate, the sweeter your gain.