Crescent in literary means growing, increasing, or developing. But today we are going to focus on how crescent network is increasing DeFi capabilities in the Cosmos Ecosystem.

Crescent Network

Crescent network was created to provide connected DeFi capabilities for the Cosmos Ecosystem in order to improve capital efficiency and risk management.

It focuses on three main functionalities:

- Crescent DEX

- Crescent Boost

- Crescent Derivatives

Crescent Network will commit to and evolve toward the fulfillment of the following goals:

- Providing a multi-chain asset marketplace with capital-efficient liquidity incentivization

- Developing a cross-chain collateralization protocol that allows users to properly manage portfolio risks.

- The team will create a variety of utilities that will be perfected by the community through governance, each embracing the network’s key fundamentals.

- An interface for order book and limit order functionality, as well as market makers’ incentives to improve liquidity, including range liquidity for optimized LP reward, will be available soon.

Crescent DEX

The long-term road to a decentralized, active network begins with Crescent DEX, a marketplace that embodies the foundational direction:

- Maximization of capital-efficiency through Hybrid AMM/Orderbook methodologies via fair order matching mechanism

- An incentive structure designed to optimize capital-efficiency and quality of liquidity

- Prioritize security when handling exchanges of bridged assets

- No trading fees until a reasonable, justified cause is presented

The structural design of Crescent DEX prevents:

- Unnecessary low-latency competition

- Front-running and validator extractable value (VEV)

- Attack vectors that exploit LP or market makers

while encouraging:

- Healthy order price competition among traders and orderbook market makers

- Participation by market-makers, regardless of scale

- Attraction of frequent traders, market makers and arbitrageurs

- An optimized trading fee distribution plan in the future for LP, market making, and CRE staking rewards

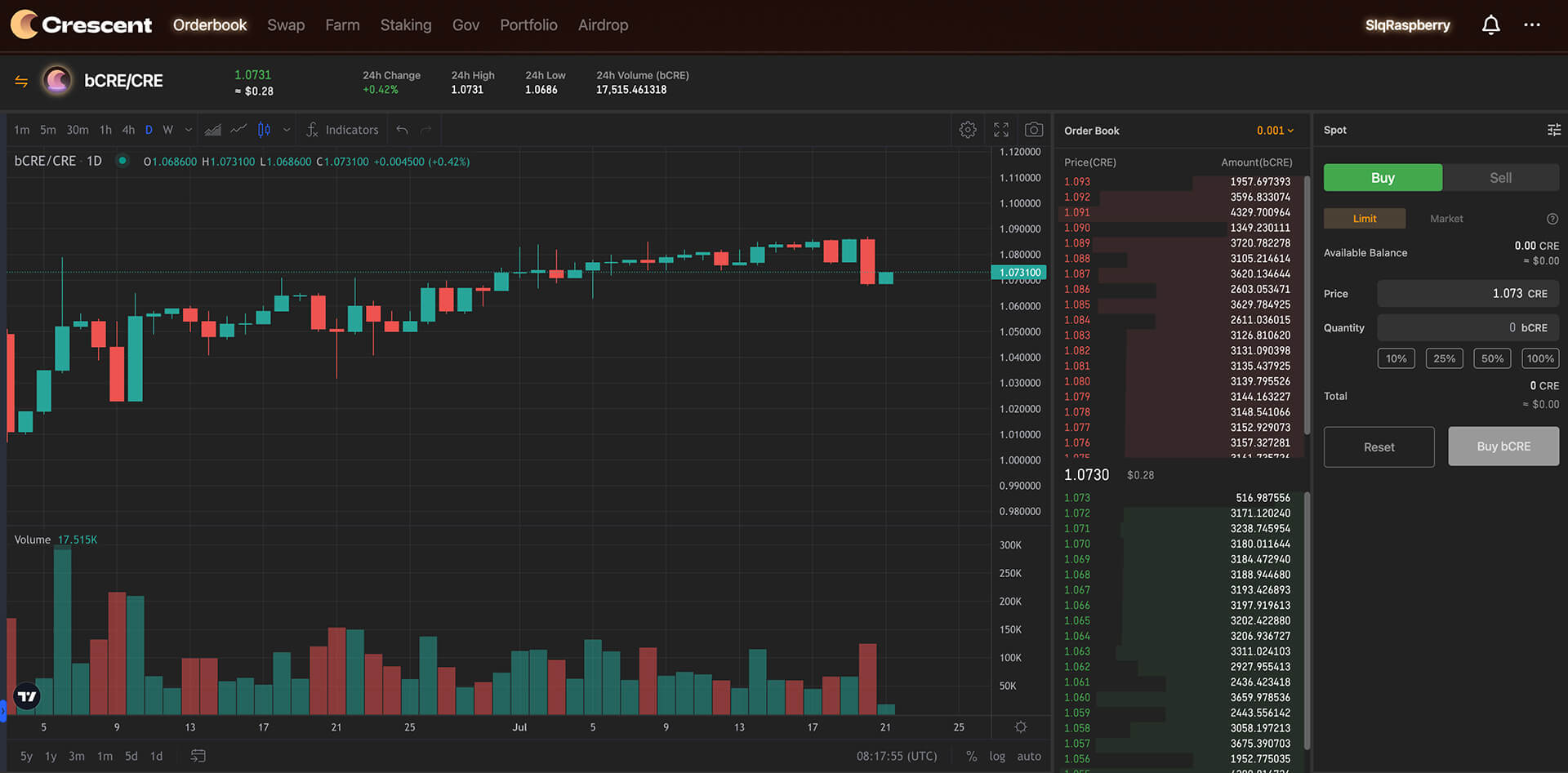

The Crescent DEX is coming to mobile soon, with l a glimpse of the User interface shown below:

Some features of the Decentralized exchange:

1. Orderbook and Tick System

Orderbook

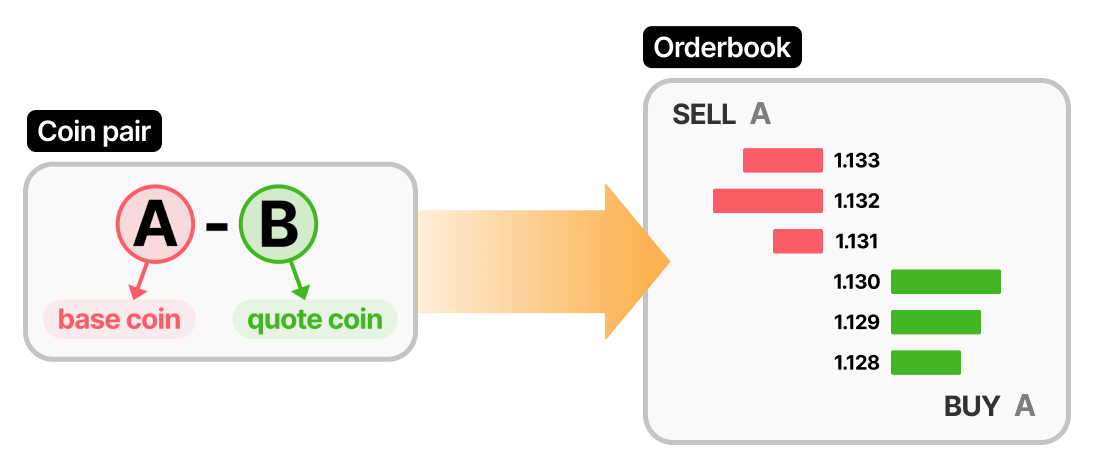

Crescent Network introduces the concept of an orderbook for versatility and visibility. For a coin pair, a single orderbook is given. The users can submit both limit and market orders and transparently observe existing limit orders on orderbooks.

Tick System

Crescent Network introduces tick system alongside with enabling order book feature. Tick system allows better data and calculation efficiency, and also orderbook standardization for users who are familiar with traditional orderbook system. The size of tick can be adjusted by a governance proposal.

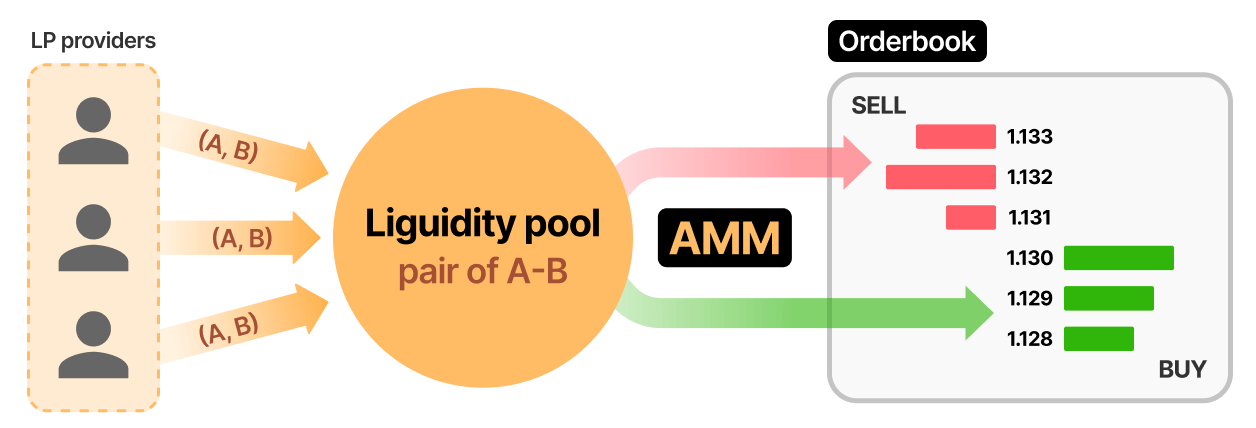

Relationship between Liquidity Pool and Orderbook

Recent enhancements in blockchain technology have allowed developers to build scalable, automated utilities upon trustless infrastructure. One utility class that has evolved significantly is Automated Market Makers (AMM). In Crescent Network, a liquidity pool becomes AMM so that it allow investors without significant capital or financial knowledge to invest in market-making opportunities. The liquidity pool of a coin pair automatically makes orders in the orderbook of the coin pair by CPM (Constant Product Model).

As illustrated above, LP providers who deposit two different types of coins into the pool while the liquidity in the pool is automatically converted to the orders to be submitted to the orderbook.

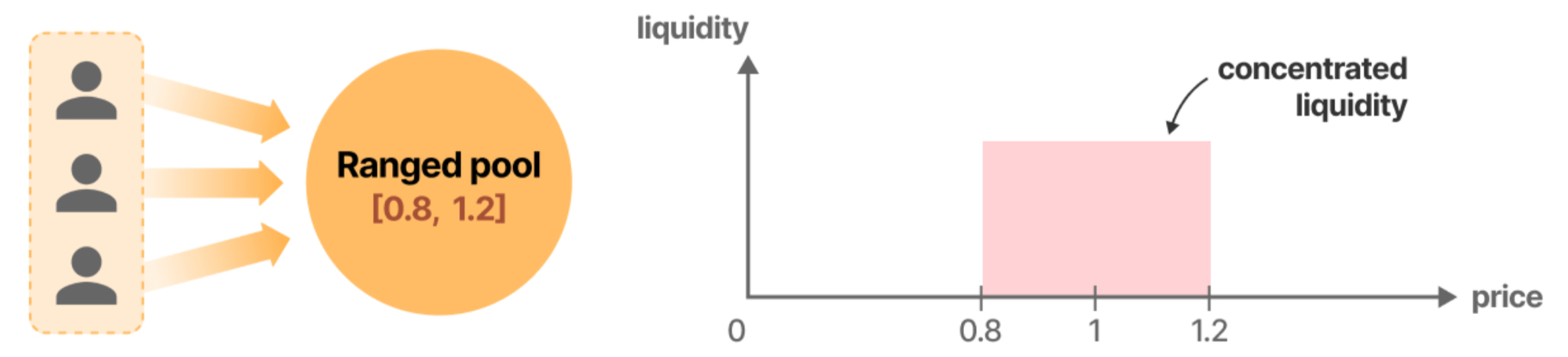

2. Ranged pools

Ranged pools are customized pools which provide liquidity only within a predefined price range of a given token pair. It gives multiple use cases such as:

- Pools with similar token pairs with maximized capital efficiency

- Leveraged pools within specific price range

- One-sided pools which only require one kind of token to be deposited for liquidity providing

- More sophisticated liquidity providing methodology for professional market makers

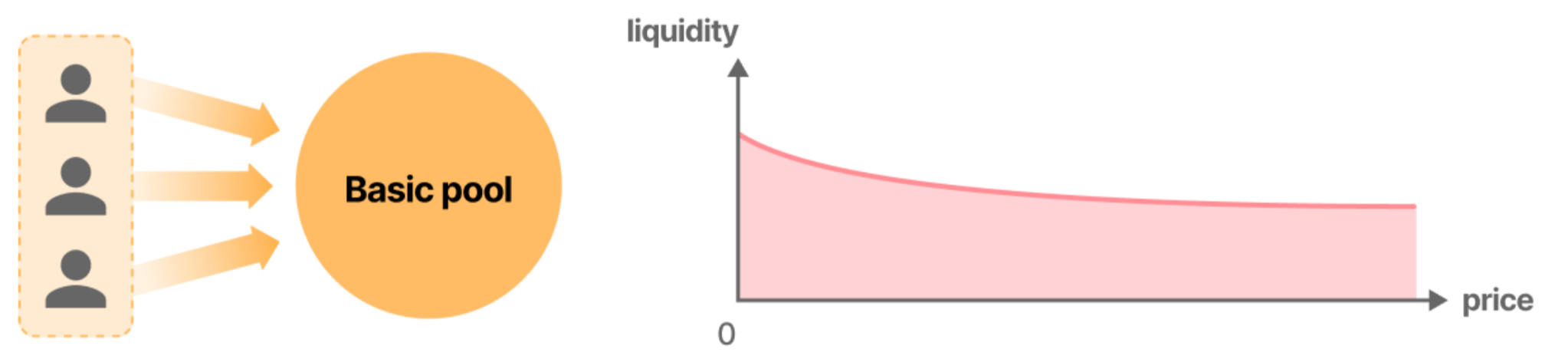

Comparison with Basic Pool

A basic pool provides liquidity in all price range, which means that a user can buy or sell a coin in any price. However, the trading amount at a given price by the pool becomes not much large since the liquidity of the pool are spread over all the price.

Once the liquidity is concentrated in a specific range of the price, enough liquidity can be provided for trading market in the price range even with the small capital. The following example is a ranged liquidity pool with the price range from 0.8 to 1.2. In this regards, the ranged pool could be more useful to the pair with stable price, e.g., bCRE/CRE, ETH/ETH, and USDC/USDC pairs.

Crescent Boost

Crescent Boost is a combined product of Lending, Hedging, and Leveraging. Crescent Boost will provide Crescent DEX LP providers ways to hedge and leverage the LP position so that LP investors can tailor their risk-return profile, even market neutral strategy with amplified farming rewards.

A part of the ecosystem incentive will be in place for the users of Crescent Boost, a key product of Crescent to use other functions. In the long-term, the vision for Crescent is for Boost to be the core function, so we believe the highest portion of incentives should be designated for Boost rewards. Crescent is an ever-evolving Hub, and future additions will also be eligible for incentives, and the incentive ratio for each product within the Ecosystem Incentive is subject to change to be best optimized for future direction. More detailed information about Crescent Boost will be announced soon.

About 01node

01node is a high quality staking and validation service headquartered in Romania. We have the expertise and time tested infrastructure as a highly secure and reliable node. Our track record shows this reliability, We prioritize great focus on security and we ensure the best practices for every service we offer. We aim to provide the best performance and reliability through our physical infrastructure collocated in tier-3 datacenters.

We are a team of highly skilled and dedicated professionals with decades of experience in the fields of software development, IT infrastructure, cryptography, and financial services. Our existing validator nodes have secured value on several POS networks since their inception such as Terra, Iris, Solana, Cosmos, Near, E-money, IOV, Solana, Skale, Secret Network, Oasis and others who will soon launch like Celestia or Nomic chain, and Near Protocol.

Our community has an active voice in how we participate in the decentralized ecosystem, and our combined strength will propel the project towards a successful future. We vote on most of the governance proposals, and consult with our delegators before this, it’s important to note that we always vote on what is best for the network.